There’s no question that technology and wealth management have become inextricably linked. Investors are increasingly weaving tech tools into their financial journey and looking for advisors to support them by doing the same.

But not all technology is especially valued or welcome by today’s affluent investors. What’s more, the acceptance and usage of specific types of technology often differ based on factors like clients’ age and net worth.

The upshot: More than ever, advisors need to deploy technology intelligently within their client service offering. That means focusing not only on what tech tools are important to various client segments today, but also on the emerging tech that may help advisors deliver a more robust experience to their future ideal clients—and differentiate themselves from the pack.

CEG Insights recently surveyed 1,313 wealthy investors about their views on fintech and their advisors’ use of it. Here are some of our key findings.

Tech And Client Communication: Legacy Meets Modern

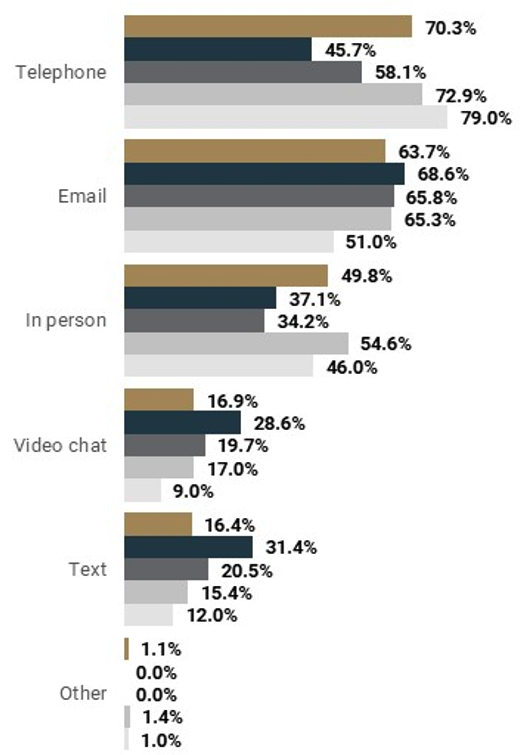

Overall, phone calls and emails are the preferred methods of communication with advisors (see Exhibit 1). But while older generations still lean toward these traditional outlets, younger cohorts (millennials, in particular) are driving a clear shift towards digital—with preferences for text (31.4%) and video chats (28.6%). These clients’ proficiency with digital tools has led them to prioritize platforms that merge technology with expert financial guidance.

Exhibit 1: How Investors Want To Communicate With Advisor (By Age)

Tech And Client Education: Improvements Needed

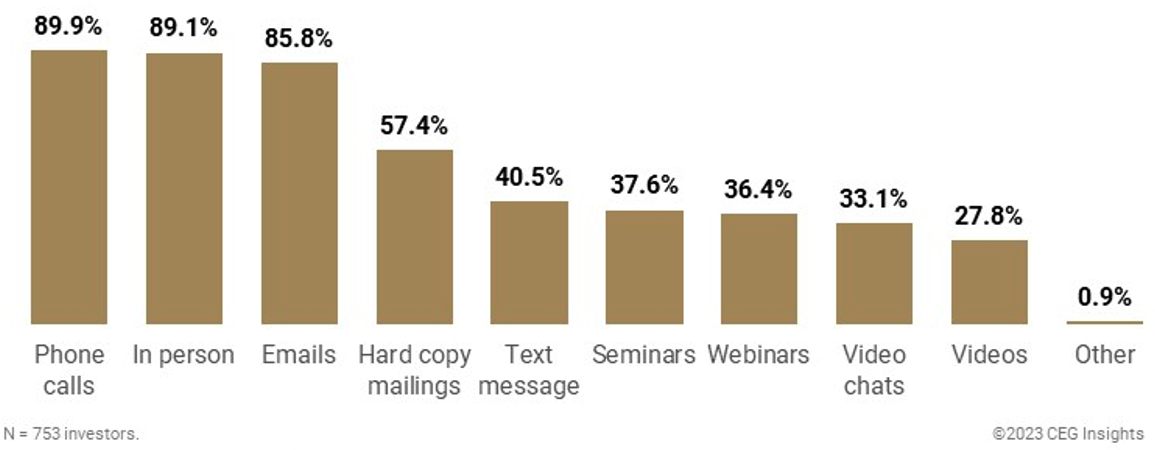

When it comes to learning more about financial—or investment-related topics through their advisors, the vast majority of clients (85% or more) cite the effectiveness of phone calls, in-person meetings and emails (see Exhibit 2).

Note, however, that approximately one-third of clients rate digital formats such as video chats, webinars and seminars as effective—suggesting a growing receptivity towards digital education tools. Unfortunately, only around 30% of clients rate advisor's videos as high quality—a sign that there’s significant potential for improvement in advisors’ digital content offerings.

Exhibit 2: Investor Opinion On Effectiveness Of Advisor’s Educational Methods (Highly Effective/Somewhat Effective—By Total)

Tech And Financial Planning: The Young And The Wealthy

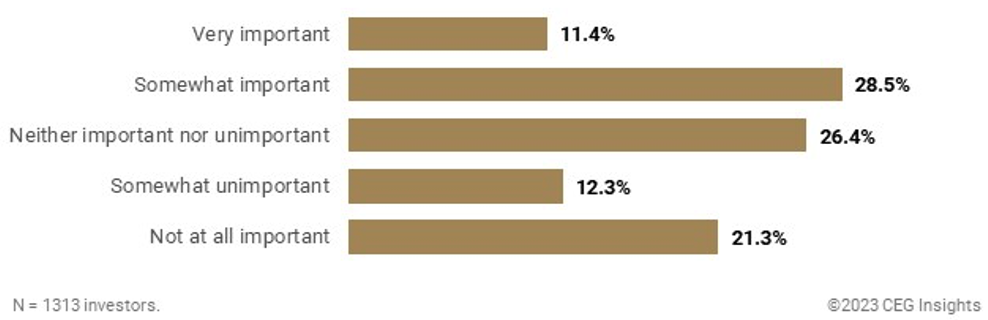

We also see significant client interest in digital tools for financial planning, particularly among specific demographics. Overall, roughly 40% of clients say it’s important to have access to financial planning software (see Exhibit 3).

Exhibit 3: Importance Of Access To Financial Planning Software (By Total)

Digging deeper, however, we find greater demand from two distinct groups:

1. Younger clients. 63.5% of millennials, along with 49.5% of Gen-Xers, want access to financial planning software.

2. Wealthier clients. 47.3% of the wealthiest clients ($10 million - $25 million in net worth) want access, versus 36% of clients with $1 million to $2.9 million.

The data suggests a tangible opportunity for advisors to demonstrate the value of financial planning software, showcasing its benefits in efficiency and customization.