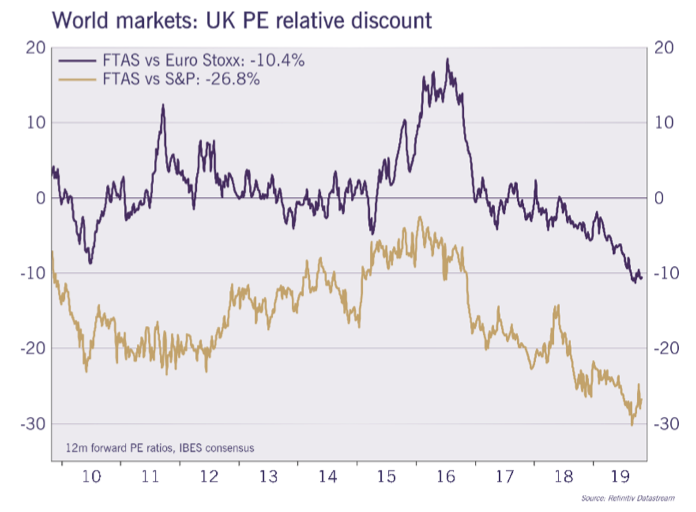

UK equities look particularly attractive in this context. The FTSE All Share Index currently trades at the biggest discount since the Global Financial Crisis, relative to both European and US markets.

A resolution of much of the uncertainty surrounding Brexit would undoubtedly be positive for business investment and economic activity – as much as an additional 1.5% to GDP (Source: SWMitchell Capital/Berenberg) – which means the UK market combines excessively cheap valuations with the prospect of positive earnings momentum.

Of course, a Brexit resolution would also benefit economies in Continental Europe also, with forecasters suggesting a 0.5% boost to European GDP (Source: SWMitchell Capital/Berenberg).

Our Task—Seeking Small Cap Equity Opportunities Across Europe Amidst Change

Our task at SW Mitchell Capital for our small cap European strategy remains to focus on finding exceptional companies that will thrive independent of shifting political dynamics. For our portfolios, we have found what we believe to be a select group of compelling UK domestic companies trading at attractive valuations, including:

• City Pub Company—a “roll up” of premium pubs across London, England, and Wales

• On The Beach—leading on-line provider of discount vacation packages across Europe

• Loungers—growing UK hospitality chain combining elements of cafés, pubs, and restaurants

• Dalata—Ireland’s largest and UK's fastest growing hotel operator