Bulls In The China Shop

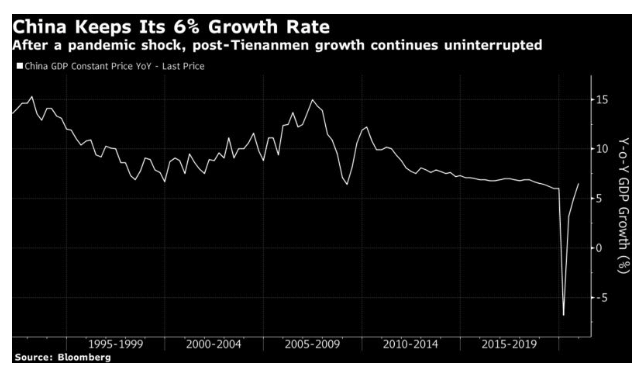

It has become one of the iron laws of economics, a constant on which we can all rely. Whatever happens, China’s gross domestic product will always rise at an annual rate of 6%.

After the briefest but most shocking of dips, and the most V-shaped recovery that could ever have been asked for, China’s GDP in the fourth quarter turned out to be 6.5% higher than a year earlier. It was a more or less explicit deal offered to China’s people by the Communist Party after the Tiananmen Square massacre of 1989; they might not get democracy, but in return the party would deliver economic growth every year.

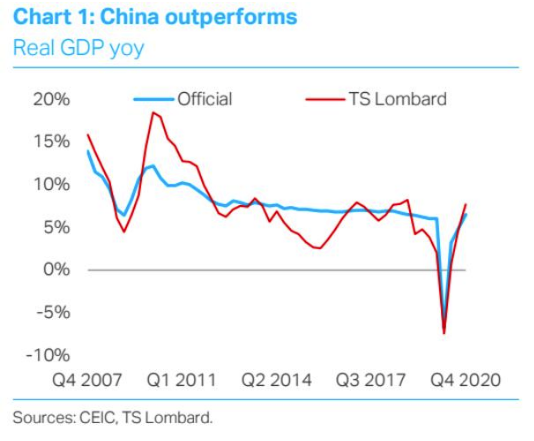

Naturally, such consistent expansion, and particularly the way China appeared to eliminate economic volatility almost entirely during the last decade as it grew at a bit above 6.5% year after year, raises questions about the data. Growth quite so strong and so steady is redolent of Bernie Madoff. However, the numbers produced by the various independent economists who track Chinese data suggest that the latest official outturn is if anything slightly understated. This chart compares the official number with the estimate produced by the London economic service TS Lombard:

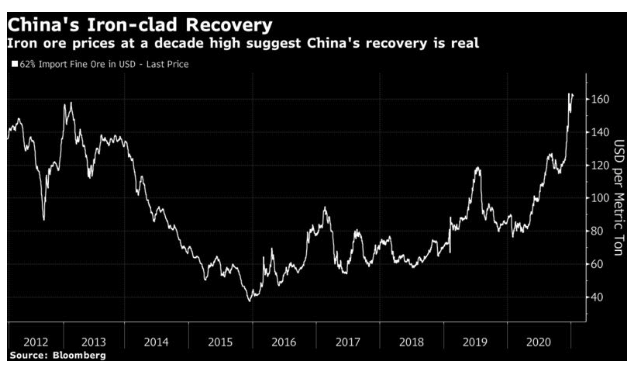

For another external sign that these numbers are a little more trustworthy than others, look at the main Chinese benchmark price for iron ore. It is at a decade high, and its trajectory over the past 10 years looks convincingly similar to the trajectory most independent economists think China’s economy took over the period:

So while skepticism is reasonable, it behooves us to accept that these growth figures broadly reflect reality. China’s economy rebounded from the seizure caused by Covid-19 to log impressive growth last year. That doesn’t mean that all is well, however.

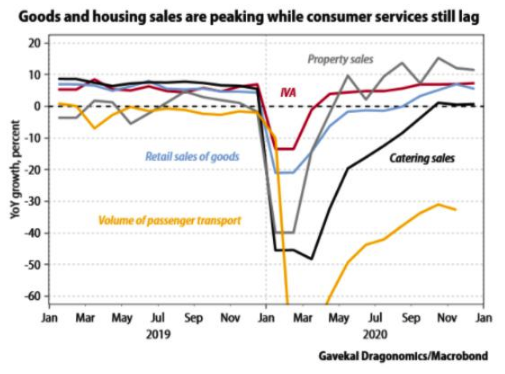

What is most important, and which might yet prove a template for post-pandemic recoveries in the West, is that this recovery is very uneven. As the following chart from Gavekal Dragonomics shows, China has a “two-speed recovery,” led in particular by sales of housing. Meanwhile, consumer services are lagging behind seriously: