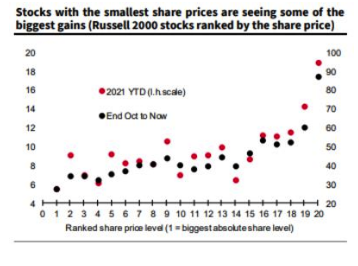

The latest and most spectacular data point I have seen on this is illustrated below, in a graph from SocGen’s chief quantitative strategist, Andrew Lapthorne. It ranks the small-cap stocks in the Russell 2000 by their share price — not their market cap, or their price-earnings ratio or anything like that, but just by the nominal price per share in dollars. The highest-priced stocks are on the left, while the cheapest are on the right. Black dots show how they have done since the vaccine trade got going in earnest at the beginning of November (on the right-hand scale), and the red dots show how well they’ve done so far this year (on the left-hand scale).

This doesn’t prove that the entire market is in a bubble. But it is overwhelming evidence of dangerously excessive speculation. The new administration appears to be staffing regulatory agencies with people who will try to get a lot tougher on Wall Street and the financial services industry again. It might make sense for brokerages to do what they can to tamp down these excesses before new regulators try to do the job for them.

Inflation And Aging

The core argument they make, which has caused the most brush-back, is that the declining share of workers in the population over the coming decades will lead to rising inflation (and interest rates), while reducing inequality. Some have supported this view — notably former Bank for International Settlements chief economist William White. Others are more cautious. Former colleague Martin Wolf, in his review, pointed to the rise of China as a classic example of a macro development of the first order that had far different effects to those that might have been expected:

Yet it is also vital to remember how little we know about how such shifts might play out in the real world. What if we had known in 1980 that China was going to open up its economy to the world and launch the biggest investment boom in world history, culminating in an investment rate of 50 per cent of GDP? How many would have predicted that the macroeconomic situation a few decades later would be one of excess savings, low real interest rates, ultra-loose monetary policies and debt overhangs? Most would surely have assumed that booming China was about to import savings massively and so raise real interest rates and export net demand, instead.

For now, it remains true that the rich in the U.S. are growing richer than ever, with a push from the pandemic. It also remains true that inflation is low, although there is every chance that headline numbers could rise considerably in the next few months, for reasons unconnected with the arguments in Goodhart and Pradhan’s book. Neil Irwin in the New York Times has a really good piece going into the different arguments for a return for inflation, and points out correctly that some are benign, such as the inevitable rise from base effects once last March’s collapse in the oil price slips 12 months into the past, and others are arguably healthy, such as the big rise in spending that is widely anticipated once people emerge from pandemic hibernation with fat savings accounts. The inflation Goodhart and Pradhan warn of would be deeper-rooted and pose greater problems.

Survival Tips

So let us find one element to cheer about what will at best be a downbeat affair. Nile Rodgers, the disco genius behind songs like We Are Family and Le Freak will be performing for an online celebration, as will country music titan Garth Brooks, who is denying that he is making a political statement by doing so, and the great 1990s one-hit wonders New Radicals. The new administration has also released a 46-track playlist for the occasion. It’s eclectic, running from Vampire Weekend through Steely Dan and Led Zeppelin to Dua Lipa and Mary J Blige. At the very least, it all makes a pleasant change from much more YMCA. Worth listening.

John Authers is a senior editor for markets. Before Bloomberg, he spent 29 years with the Financial Times, where he was head of the Lex Column and chief markets commentator. He is the author of The Fearful Rise of Markets and other books.

It cannot be good that a low share price counts for so much, or that people are gobbling up penny stocks in a way that pushes up their price to this extent. This has been happening as global stocks consolidated last week.

This is a reminder that we are reviving the Authers’ Notes Bloomberg book club. The current selection is The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival by Charles Goodhart and Manoj Pradhan. The idea is simple. Get hold of a copy and read as much as you can. Then bombard us with questions and follow the live blog we will be holding on the terminal on Feb. 10 at 4 p.m. London time/11 a.m. New York, where I will discuss the book with Pradhan, and some other guests.

Wednesday’s presidential inauguration has become a matter of deep foreboding across the U.S. political spectrum. Many believe it is the moment when an illegitimate president will take office; many more fear that it will be the scene of violence and bloodshed, possibly on a greater scale than was witnessed on Jan. 6.