President Trump’s election platform “Make America Great Again” included protecting jobs and building businesses in the United States. To that end, U.S. Treasury Secretary Steven Mnuchin, Secretary of Commerce Wilbur Ross and the Director of Trade and Industrial Policy Peter Navarro have been working to normalize trade with our global trading partners. The focus is on normalizing unfair trade practices with China and Germany, but this also includes Canada and Mexico. China exported roughly $525 billion worth of goods to the United States last year and imported only $135 billion. President Trump is seeking to narrow that gap. Any efforts to narrow the trade deficit through tariffs will slow economic growth in China. Ultimately, a trade spat will slow economic growth in the United States near term as well. With respect to China, we expect Trump’s goal is to normalize bi-lateral trade at the margin and to take steps, which have yet to be defined, toward protecting intellectual property that China steals from the United States.

The Chinese Economy

In 1972, President Nixon and Henry Kissinger broke a 25-year period of no communication between China and the United States and visited China. Up to that point, China was an underdeveloped country focused on rebuilding its economy after World War II. After normalizing relations, trading between the two countries began to grow. The socialist market economy of China, which includes state-owned businesses and centrally planned control, is now the world's second largest economy by nominal GDP. In addition, China is the world's largest manufacturing economy and exporter of goods according to the International Monetary Fund.

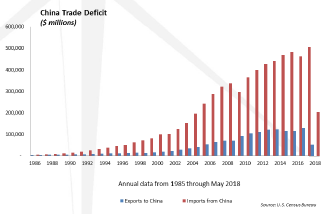

In the 1960s and 1970s, the words “Made in China” implied that, whatever it was, it was cheap and low quality. However, over the last three decades, China has invested heavily in its cities, manufacturing facilities, equipment and infrastructure in order to build a strong manufacturing-based economy. The impact on the trade balance has been dramatic. In 1990, the trade deficit the United States ran with China amounted to $10 billion. By 2017, the trade deficit had ballooned to $375 billion. This means that China sold more goods to the tune of $375 billion each year to the United States than we sold into China.

It is important to remember that China’s economy and capital markets do not represent free market capitalism. China’s form of capitalism is orchestrated by their central government. We have written over the years about how the Chinese economy works and recommend the book Red Capitalism by Carl Walter and Fraser Howie for a deeper understanding of China’s financial and capital markets system.

In its simplest form, the Chinese government injects capital into its banking system. The banks extend loans for construction, real estate, consumers and businesses; however, the central government effectively mandates the amount of loans a business receives. When the debt is not repaid, the problem loan may remain on the balance sheet of the banks, and the government injects more capital. As a result, China now boasts the world's largest total banking sector assets of $39.9 trillion with $26.5 trillion in total deposits. Discerning loan growth and quality is difficult for us since the data is suspect.

China’s central government has indicated that they are targeting economic growth of 6 percent. This is lower than the 10 percent average growth rate of the past 30 years.

The Impact Of Tariffs On China And The United States

This Administration has taken a more aggressive stance toward normalizing long-standing trade agreements with countries with which we trade in an effort to address unfair trade practices. China has been a net beneficiary of U.S. trade policy over the past 30 years. In addition, China unveiled a plan three years ago called “Made in China 2025” which identified 10 industries that China wanted to become globally competitive in by the year 2025. The tariffs that have been implemented and are proposed take aim at many of the industries highlighted in this plan. We expect China will not back down from its 2025 plan.