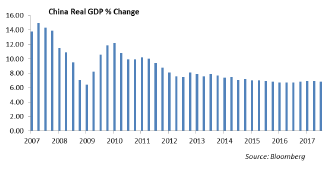

Two of the three scenarios we outline result in a slowdown in the growth of the Chinese economy. We do not believe the capital markets have discounted the impact of a slowing Chinese economy and the risk of the potential deterioration in the Chinese financial system. We believe that the Trump Administration knows that this is leverage they have and they are willing to use that leverage for the purpose of reforming trade agreements.

At the margin, the initial tariffs will hit earnings of companies in the manufacturing and technology sectors as raw materials costs and supply chain disruptions negatively impact margins. We also expect a slowing in business investment and capital expenditures as uncertainty causes management to rethink near term investment plans.

A prolonged trade war will act to suppress U.S. interest rates as economic growth slows. However, China’s demand for U.S. Treasury securities, which it uses to hedge its trade with the United States, may decline depending on the impact tariffs have on Chinese exports.

Gregory Hahn is president and CIO of Winthrop Capital Management.

The Trade War End Game

July 12, 2018

« Previous Article

| Next Article »

Login in order to post a comment