Year-end tax planning isn't what it used to be. Usually, practitioners can at least say they have a handle on the relevant rules. But not this year.

"It's tough to advise clients because we're waiting to see what income tax rates are going to be in 2011," says Mike Tedone, the chief compliance officer at Filomeno Wealth Management LLC in West Hartford, Conn. "We're trying to determine whether it makes sense to accelerate income into 2010, especially long-term capital gains."

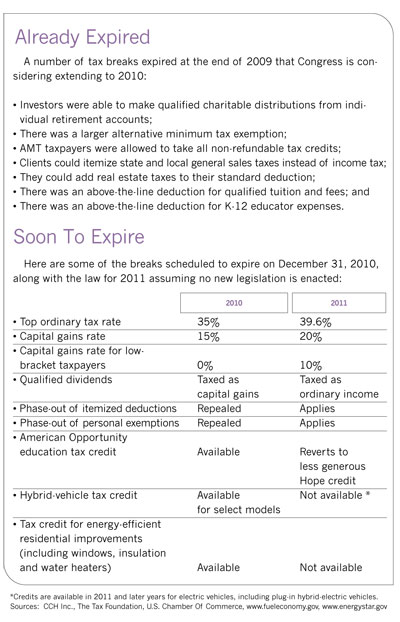

The question is whether the Economic Growth and Tax Relief Reconciliation Act of 2001 will be allowed to sunset after December 31. If it does, tax rates will climb in 2011. That means advisors will want to bring income forward into 2010 wherever they can.

President Obama has proposed allowing the rates to rise in 2011 only for joint filers with incomes above $250,000 (or single filers with incomes of more than $200,000). Congressional Republicans have thumbed their noses at that idea, and classic Washington gridlock could keep new legislation from being enacted, which means EGTRRA's goodies will perish. But even if that occurs, in January the new Congress might reinstate the lower rates and other expiring breaks, says Mark Luscombe, a federal tax analyst at CCH Inc. in Riverwoods, Ill.

The 2001 act's demise would also resurrect the phase-out of itemized deductions, which is gone this year. Luscombe says the administration wants to restore the phase-out for taxpayers with incomes greater than the same high-income thresholds, and advises clients who might be subject to the phase-out in 2011 to think about accelerating deductions such as charitable contributions and real estate tax into 2010. You have to determine which is better: a full deduction in 2010 taken against lower tax rates, or a potentially smaller deduction in 2011 taken against potentially higher rates.

Besides the 2001 act, other sections of the tax code are in flux, too, including the so-called patch necessary for keeping millions of taxpayers from the clutches of the alternative minimum tax. "For 2010, the AMT exemption amount has reverted back to $45,000 for joint filers" from $70,950 in 2009, Luscombe says. Moreover, the ability to take certain non-refundable credits against the alternative tax has also expired. If a patch for 2010 is not enacted, the Tax Policy Center puts the number of AMT taxpayers at nearly seven times last year's figure.

(The sidebar recaps some of the breaks that are coming and going and may be coming back.)

Roth Conversions: The Big No-Go

A lot of hoopla surrounded the eligibility this year of all taxpayers, regardless of income, to convert traditional individual retirement accounts to Roths. But so far few clients have been willing to cough up the ordinary income tax that's due on a conversion, even if they have the funds outside the account to cover it. As one high-net-worth client put it to Cass Chappell, the president of Chappell, Mayfield & Associates in Atlanta, "I agree I'm probably going to pay higher taxes in the future, but I don't care what the numbers say. I want to hang on to my money."

Some Tea Party clients with a great fear of future taxation have the opposite problem and would rather pay now, in an odd twist, even if it's not appropriate for them. Raleigh, N.C., planner Gerald Townsend reports, "I've had to calm down some of those and say, 'You act like you're making $500,000 a year when you're making $50,000. Your tax bracket is not going to zoom upwards in retirement but will probably be lower than it is today, so don't get emotional and convert and pay a lot of taxes.'"