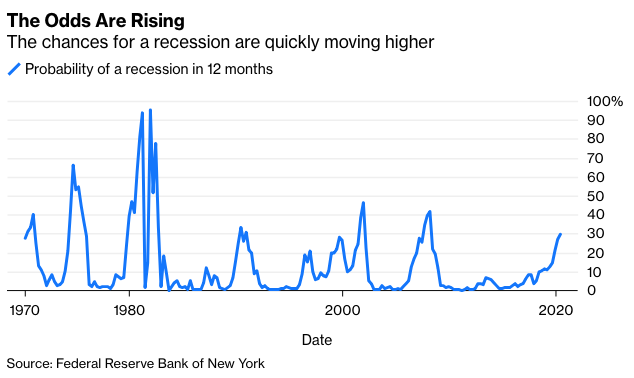

So for investors to get any useful information on business cycle timing, they have to rely on current data, and revisions, and attempt to peer into the darkness of the future. I’m now not only using employment data but also information such as the weakness in commodity prices, which tells me that global economic growth is falling fast. I like copper as an indicator since it’s used in almost every manufactured product. I also follow the Organization for Economic Cooperation and Development’s total leading indicator index, which is now declining, and the New York Federal Reserve’s Probability of Recession index, which has reached its highest since early 2008.

The recent action in U.S. Treasury securities, with the yield on the 10-year note falling 1.15 percentage point since November, and the 30-year bond’s yield falling by 0.92 percentage point, is a strong indicator that a recession and even lower inflation are at hand.

Treasury yields are sometimes a better forerunner of recessions than stock prices, and since early January equity investors have been enamored of the prospects of for lower interest rates from the Fed. But recessionary declines in already-decelerating corporate earnings may change their minds. The S&P 500 Index’s drop of almost 20 percent late last year may prove to be the forerunner of the usual recession-related bear market.

This article was provided by Bloomberg News.

Those U.S. Jobs Revisions Are Hard To Ignore

July 2, 2019

« Previous Article

| Next Article »

Login in order to post a comment