A new study by the American Enterprise Institute says that 10 cities are facing a threat to their real estate markets because of the higher number of homeowners behind on their mortgage payments. That trend not only threatens the 10 markets but much of the country, says the conservative think tank.

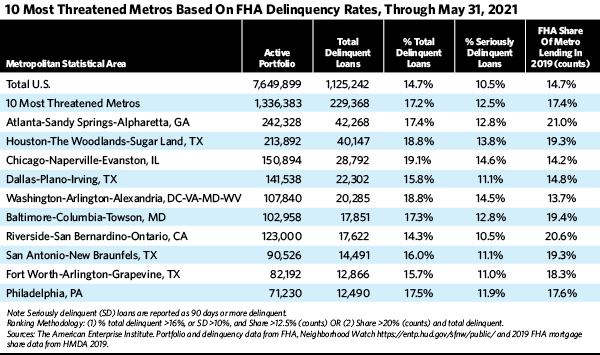

The most delinquent owners are those with mortgages backed by the Federal Housing Administration (FHA). About 14.7% of the 7.6 million FHA mortgages outstanding nationwide were delinquent as of May, up slightly from the previous month, the institute found. Atlanta and Houston were the cities most at risk.

Delinquent mortgages are those with payments 30 days or more past due.

Some 10.5% of the FHA loans were seriously delinquent, meaning they were 90 days or more past due and the borrowers were in danger of going into default.

“A buyer’s market could develop in ZIP Codes with heavy exposure to such borrowers,” wrote the authors of the study—the institute’s housing center director, Edward Pinto, and research fellow Tobias Peter.

Atlanta had a default rate of 17.4%, while Houston’s was 18.8%.

These are the metro areas most at risk:

In April, Philadelphia replaced Orlando, Fla., on the list of the 10 most threatened areas.

Homeowners who aren’t able to sell or modify their loans are likely to face foreclosure or other financially challenging options, such as a short sale, the researchers warned.

“The group of borrowers who voluntarily choose to sell or who lose their home to foreclosure or other disposition will be adding to supply,” the institute said, and that could trigger buyer’s markets in areas with high concentrations of FHA loans and other high-risk mortgages.