Because the phrase “Trade War” has been in the news so consistently of late, investors have naturally felt the need to ask us, given that we manage an international mutual fund, how the trade wars could affect our fund. It is impossible to say with any high degree of specificity given we don’t know how these trade disputes will turnout. However, looking at our investment approach and style could be helpful in gauging any potential impacts from these disputes.

First, let us preface our comments by saying that we are “free traders” at heart. The imposition of tariffs certainly can cause economies driven by global trade to be less robust. While free trade is a “good thing,” unfettered free trade may not always be in the best interests of a particular country. Frankly, world governments do not allow unfettered free trade. Ultimately, erecting trade barriers (or their removal) are politically-calculated decisions designed to appeal to different constituencies at a point in time.

The issue is not really about free trade versus tariffs but changing the current tariff regime. These potential changes undoubtedly can have adverse impacts on certain industries and global trade in general. However, it is instructive to note that much of the trade noise we hear is to some degree part of the current negotiation strategies being carried out between countries. Usually this process takes place behind closed doors, and when tariffs or penalties are imposed, it typically doesn’t garner much press.

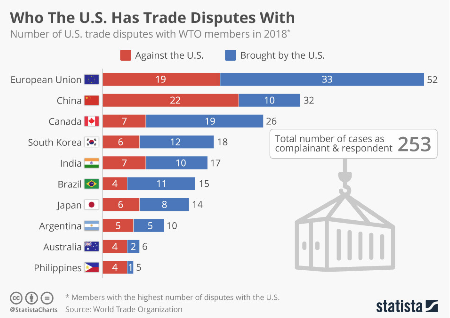

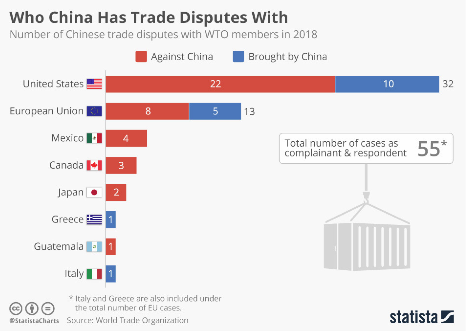

The frequency of trade disputes can be seen in the World Trade Organization (WTO) data as of April 30, 2018:

Political motivations are also why countries such as China and Mexico favor imposing tariffs on industries viewed as heavily populated by the current administration’s political base. Meanwhile, in news last week, European automakers agreed to the removal of trade barriers for U.S.-manufactured cars, while $34 billion of Chinese tariffs and their retaliation went in to effect. Markets reacted positively to both events.

Experts suggest a full trade war between the United States and China could slow the rate of economic growth by 0.7 percent for the United States and for China by 0.6 percent. For an all-out global trade war scenario, the same experts suggest U.S. real Gross Domestic Product (GDP) could slow by as much as 2.2 percent and for China GDP by as much as 1.7 percent.

As a reminder, the above numbers are an estimate of the potential slowdown in the rate of GDP growth. To gauge the impact, the United States is estimated to have real GDP growth of around 3 percent this year, while China’s real GDP growth is expected to come in around 6.5 percent.

Effects On Companies