The University of California plans to double the endowment’s investments in private equity and trim stock holdings, the latest move as it tries to improve performance.

The $9.9 billion endowment had a 7.1 percent investment gain for the six months through Dec. 31, propelled by global stocks and private equity. Endowments of all sizes gained a median 4.4 percent in the same time, according to Wilshire Trust Universe Comparison Service, a database provided by Wilshire Associates.

Jagdeep Bachher, who has been trying to boost performance since he became CIO almost three years ago for the 10-campus state system with $103 billion in endowment, pension and retirement assets, said he’s focused on long-term results and managing risk.

“It’s not a short-term target,” Bachher said Wednesday in an interview. “Timing isn’t our priority. I guarantee I’m not going to just be filling buckets.”

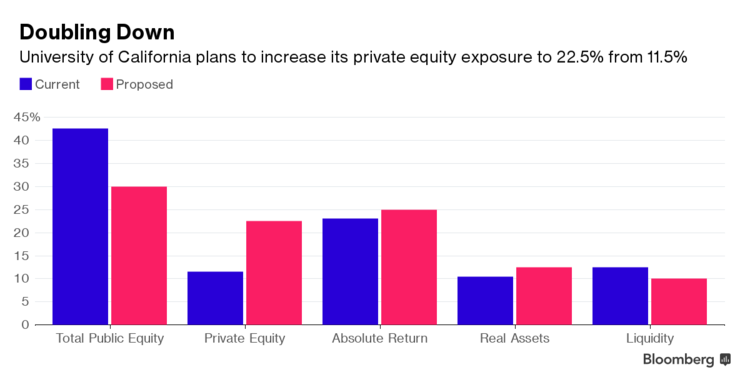

Bachher, at a board of regents meeting Tuesday, said the private equity asset allocation in the endowment will almost double to 22.5 percent from 11.5 percent. The target for equities will be reduced to 30 percent from 42.5 percent. Absolute return, which includes hedge funds, will increase marginally to 25 percent from 23 percent.

Hedge funds in the endowment have been cut to 65 from 175 about two years ago, Edmond Fong, a managing director, said at the meeting.

The investment office is “looking like hawks” for opportunities to cut fees, Bachher said, and performance fees are paid if the manager delivers above a hurdle rate.

“No hurdle rate, no business,” Bachher said at the meeting, without detailing the process or the rate.

Co-Investments

Bachher said in the interview that his office will look for venture capital investments and opportunities like co-investments to expand its private equity portfolio.