Following a rise to 1.5% in September 2016, Headline Consumer Price Index (CPI) in the United States is set to move above 2% as we enter the first quarter of 2017.

The increase will initially be a result of favorable base effects and seasonality originating from a period of poor energy sector performance falling out of the year-over-year comparisons. However, is there more to this story? We believe there may be given a number of leading indicators suggesting inflation pressure may be starting to become more embedded. How the Federal Reserve (the FED) will react to and adjust their monetary policy stance in response to this faster pace of inflation is likely to be one of the more important questions facing investors in 2017.

US Inflation Outlook

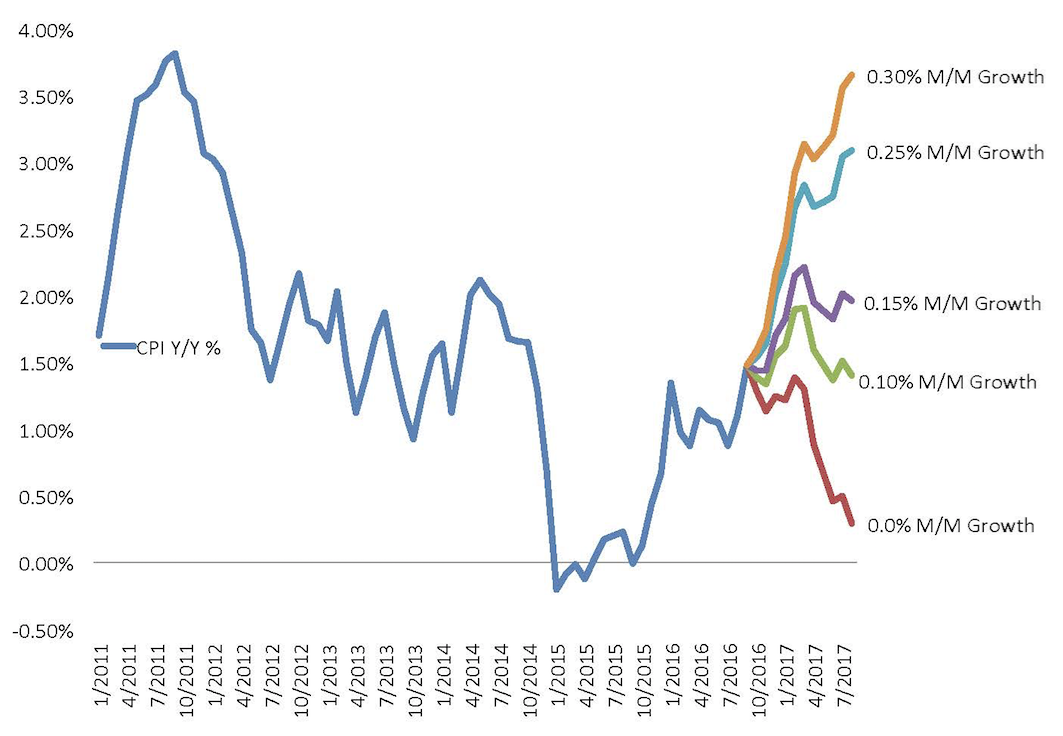

Conducting a simple scenario analysis shown in the chart below, it is easily observed that modest monthly increases in US Headline CPI over the coming year may result in rising headline inflation. Gains of 0.25% on average per month could push CPI above 3% by Q2 2017.

A rise of 0.25% on average per month will result in Headline CPI rising to 3% by Q2 2017

Investors and the Federal Reserve may be inclined to first attribute this potential rise in inflation to the “base effect” story from energy markets, the idea that at a minimum the normally observed seasonal declines in gasoline and energy prices in the tail end of 2016/early parts of 2017 are likely to be smaller and less severe in 2016 than those experienced over the last few years, thereby biasing yearly comparisons higher. However, we believe this view to be an oversimplification and note other factors at work that may likely contribute to a more sustained rise in US CPI.

Food Prices appear to be bottoming

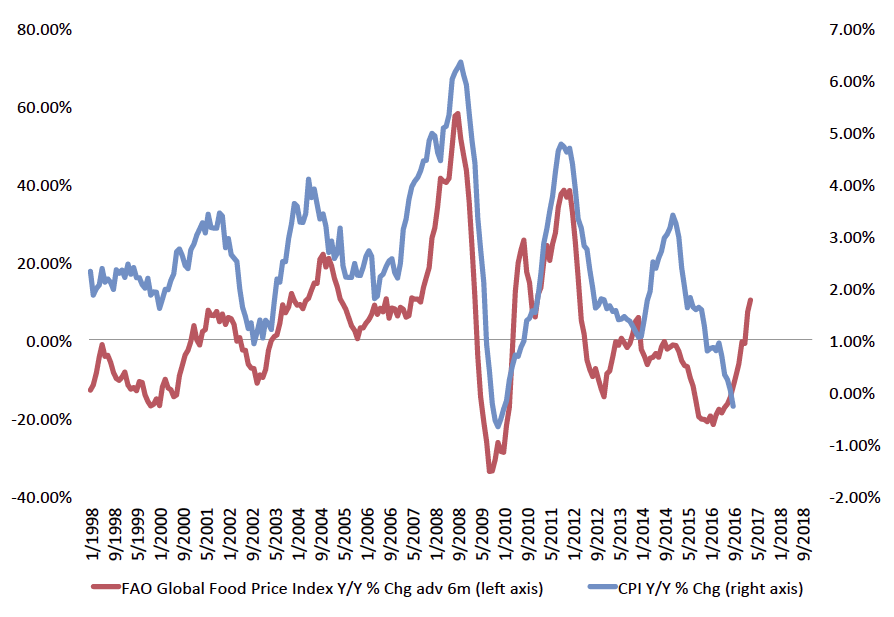

US food prices are currently growing in negative year-over-year territory and represent close to 14% of CPI. The drag from food on Headline CPI has been material in 2016, but leading indicators suggest this drag is likely to reverse. Specifically, the FAO Global Food Price Index is pointing to a re-acceleration in US Food CPI back towards growth of 2–3%. Should this materialize, we believe that both headline sectors are likely to accelerate in the first half of 2017, adding upside pressure to CPI.

Food CPI has been a drag on Headline CPI in 2016 but the FAO Global Food Price Index suggests that drag on US Food CPI is likely to reverse in the coming months.

Leading Indicators Of Core CPI remain firm

A glance across a number of historically strong Core CPI leading indicators argues for growth remaining firmly above 2% in 2017:

• Labor markets are tight and wage pressures are rising.

• Small businesses continue to report difficulty sourcing qualified/skilled labor and filling open positions.

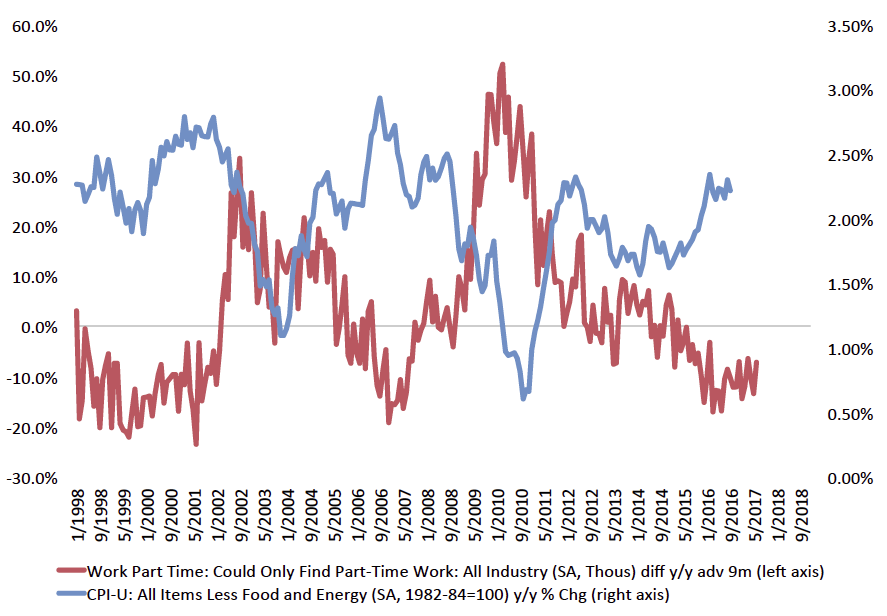

• The number of workers noting they could only find part-time work is falling quickly.

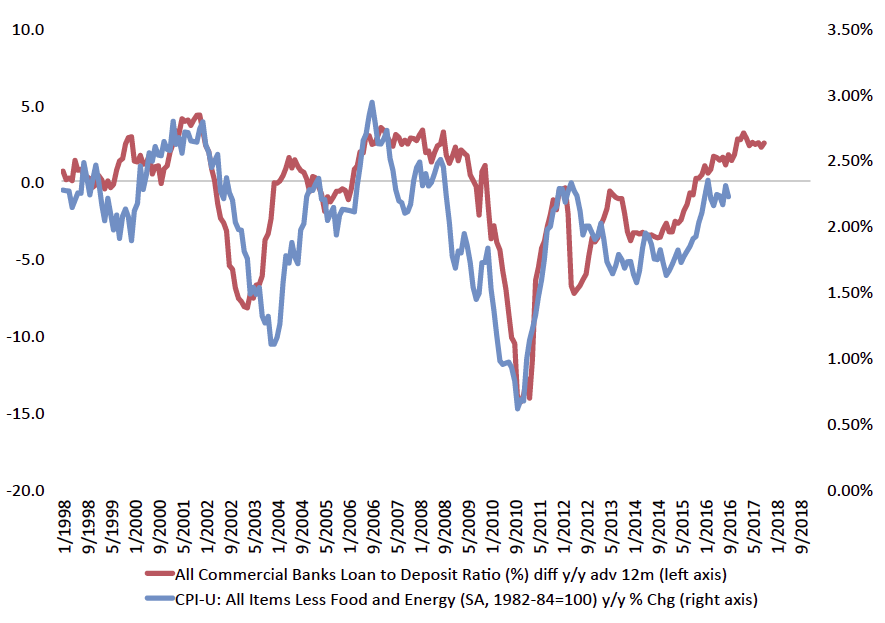

• Commercial bank loan-to-deposit ratios are expanding strongly versus a year ago, suggesting that record deposits at banks may be finding their way back into the real economy via stronger lending.

• Medical care inflation is already accelerating above 5% year-on-year in some portions of CPI with premiums set to experience double-digit accelerations for Affordable Care Act participants in 2017.

• The majority of housing market indicators suggests the cost growth of housing, both home ownership and rentals, is likely to remain between 2.5 to 3%.

The rise in commercial bank loan to deposit ratios and decline in the number of workers noting they could only find part time work suggest pressure remains on Core CPI to the upside.

How Will The Federal Reserve React?

While we anticipate that the Federal Reserve will acknowledge the rise in headline inflation, they are likely to welcome this outcome given recent rhetoric from FED Chair Yellen about running a “high pressure” economy and proceed with caution on interest rates. Specifically, the FED may stress the following:

• These near-term pressures do not necessarily suggest inflation will continue above trend in the medium term.

• There are benefits to running inflation above target for a period of time.

• It will take further observation to prove inflation is not “transitory,” given there is still some evidence of slack in labor markets, only modest wage expansion, and subdued global growth.

Furthermore, the composition of the committee may shift dovish as we enter 2017, with all three dissenting members from the September FED decision (Mester, George, Rosengren) rotating off as voters.

The initial push back from the FED may keep investors re-assured that a faster-than-expected removal of monetary accommodation is unlikely, but a prolonged period of above trend inflation in line with the leading indicators noted above (particularly if combined with faster wage growth) could push the FED toward a quicker pace of interest rate increases in 2017 than is currently priced by financial markets, even if just to protect their credibility.

Over the coming quarters we anticipate that the uncertainty associated with the FED’s response to higher levels of inflation will lead to periods of increased volatility and price discovery as investors assess a world with a less accommodative monetary policy stance. Should this uncertainty around the FED’s response coincide with the unwinding or “tapering” of extraordinary monetary policies currently being implemented by the European Central Bank, Bank of England and Bank of Japan, it may only amplify this uncertainty.

How Will President-elect Trump’s Policies Influence Inflation?

While we were anticipating a rise in inflation no matter the outcome of the election, the potential for inflation to increase further over the next year may now potentially be larger given the fiscal stimulus anticipated from a Trump presidency. Specifically, policies emphasizing infrastructure/construction, de-regulation, lower corporate and consumer tax rates and repatriation of foreign earnings held abroad have the potential to kick-start domestic Investment and push overall economic growth stronger during a period when the economy is already at full employment.

Jason Doiron, FRM, PRM, is chief investment officer of National Life Group, and head of investments for Sentinel Asset Management. He is accountable for $29.1 billion in AUM as of September 30, 2016, across the insurance company general account and institutional and retail investment strategies. He is a portfolio manager on four fixed-income and two multi-asset strategies.

Jason Doiron, FRM, PRM, is chief investment officer of National Life Group, and head of investments for Sentinel Asset Management. He is accountable for $29.1 billion in AUM as of September 30, 2016, across the insurance company general account and institutional and retail investment strategies. He is a portfolio manager on four fixed-income and two multi-asset strategies.