Velvet Handcuffs - By Russ Alan Prince , Hannah Shaw Grove - 08/1/2007

Today,

executive directors of single-family offices are compensated in one of

two ways: as an employee of the family performing a task in exchange

for a salary, or as a participant in the business and, as such,

eligible to share in the performance upside of certain investments

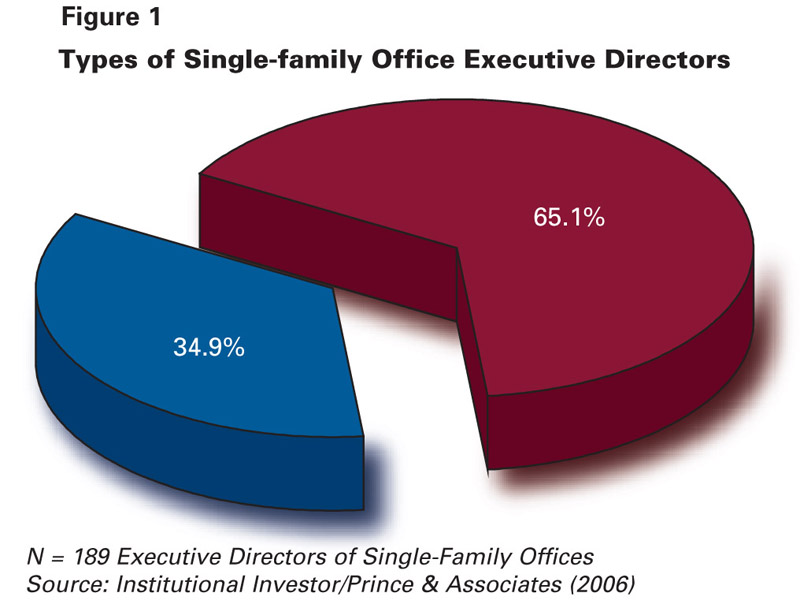

and/or be rewarded for the achievement of specified goals. Roughly

two-thirds of executive directors in our survey would be classified as

employees and the balance classified as participants (Figure 1).

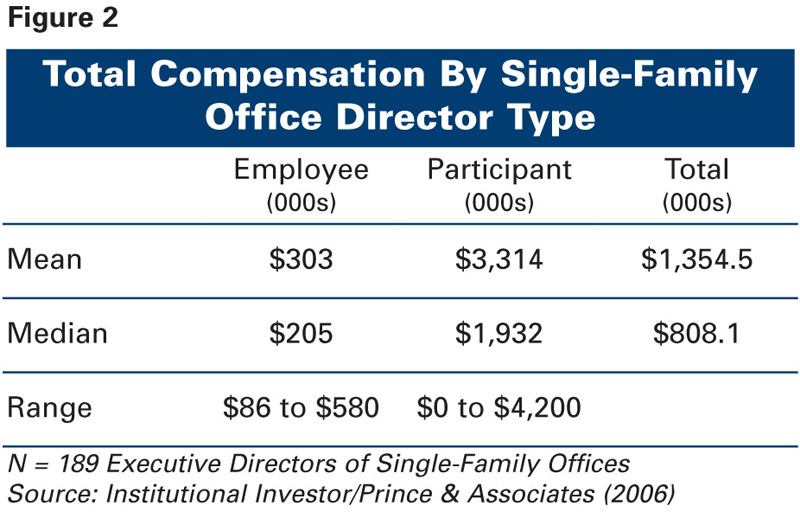

The major differences between the two types of executive directors were more clearly illustrated when we considered their total compensation (Figure 2).

Employee directors had a compensation range from $86,000 to $580,000, with a mean total compensation of $303,000 and a median total compensation of $205,000. Participant directors, however, were remunerated at much higher levels. The range of compensation for the participant directors was from $0 to $4.2 million, with a mean total compensation of $3.3 million and a median total compensation of $1.9 million.

Capturing The Structural Advantage

Just

a third of the executive directors of single family offices are

receiving some form of contingent compensation. Given the dynamics in

the market place, we believe that these types of arrangements will

become a more accepted and prevalent form of compensation in the near

future.

The demand for top-notch investment professionals, for instance, is always high; family offices will have to be innovative and aggressive in their recruitment and retention efforts in order to find and keep the best employees. A well-structured contingent compensation program can be a decisive factor in achieving long-term harmony between the senior employees and the family members in an office. It can quickly align the interests of both parties and, with deferral features, can act as a golden handcuff by providing incentives for the director to stay.

The overall benefits associated with this type of payment structure can be significant, but very few of the directors we surveyed had arrangements that allowed them to capture the advantages or truly maximize their personal wealth. When properly designed and executed, contingent compensation programs are a boon to both executive directors and the wealthy families behind them.

Creating The Right Program

A number of aspects must be considered when embarking on the development of a contingent compensation program:

1. Fit

Many

families are distinctly uncomfortable with the idea of contingent

compensation programs for any of their employees, even those filling

the most critical roles. In these cases, we find they prefer to pay

straight salaries and eliminate variability. Having a "pay for

performance" mentality is important for the success of these programs

and, in some cases, may simply be a poor fit with the family's

operating philosophy.

2. Awareness

On the

other hand, we've worked with a number of families that weren't aware

of the full range of compensation options available to them and their

employees. In these cases, an educational process must ensue, allowing

the family to make a more informed decision about the way they choose

to remunerate their executive directors. The following two elements are

distinct, but interrelated, and should be considered in the context of

the others to ensure effective program design.

3. Metrics

Determining

what roles the executive director will be paid on and how much it is

worth to the wealthy family is usually the most complicated and

time-consuming part of the process. In our experience these

conversations can be emotionally charged, as the subjective issues of

ego, aptitude and value are tackled. It is helpful to start this

process by specifying those functions performed by the executive

director that are performance- based, such as investments and tax

strategies, and those that are "accommodations," such as administrative

matters or lifestyle services. The next step is to further evaluate

each of the performance-based functions to identify which ones are

appropriate for contingent compensation and to what degree. We find

that investing activities that have clearly defined investment policy

statements, benchmarks and performance targets are fairly

straightforward, while the development of tax strategies, for example,

can require much more discussion as both the process and the results

are usually less easily defined.

4. Structures

As

a contingent compensation model is in development, the structure of the

payments should be considered. Ultimately, the structure often can be

the difference between a satisfactory compensation program and an

exceptional one. Certain structures can offer greater incentives and

better tax benefits to an executive director. Similarly, a family can

use specific structures to ensure their objectives are inherent to the

program. Some of the ways these models can be structured include using: