Logically, financial advisors would want to keep all of this group. Since anchor clients are core to a practice, it would make sense to spend the most time with them and keep them satisfied.

How To Lose Anchor Clients

Investment management might be a core service offered by financial planners, but investment performance is not the reason clients stay. In fact, in one survey, nearly nine out of 10 clients who had left their advisors within the last three years said their investment performance was actually good or even superior.

We looked closer at how these clients were being treated.

We found that the top 10 anchor clients generally got a lot of attention. But beyond those, the attention the rest got tended to drop off rather quickly and was more randomly distributed. Many of them were subject to chronic neglect. Of course, the top 10 anchor clients matter, but so do numbers 11 and 43.

Very often, financial advisors have a false sense of security that if their best clients are not calling in and investment performance is at least pretty good, then everything must be going well. And as we will see, that is not necessarily the case.

Another interesting finding is that about three out of five advisors recognize they spend most of their time on non-anchor clients. This creates an unfortunate scenario in which they could lose their best ones.

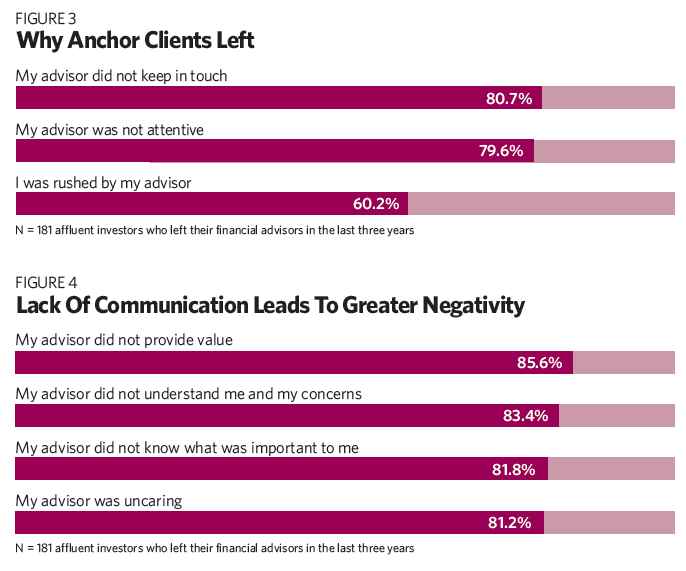

As Exhibit 3 shows, anchor clients who leave have different reasons for doing so, but one is that they are clearly not getting the level of attention they want. If an advisor starts to lose an anchor client, unless he or she takes corrective action, the bad feelings intensify (Exhibit 4).

Clearly, if advisors don’t communicate in the ways anchor clients want, it becomes more likely the clients will leave. This can have very serious repercussions. On average, almost three-quarters of advisors lose one anchor client per year, and this is a serious hit to their revenues (Exhibit 5). Clearly, silence can be deadly.