While retailers complain there’s not enough consumer spending, trillions of dollars are sitting in investment accounts. Banks have a glut of deposits, stock market valuations are high, corporations are flush with cash, and prominent investors have more money than they know what to do with. Buffett’s cash pile is just shy of $100 billion. The median U.S. worker from age 55 to 64, however, has just $15,000 saved in retirement accounts, according to a recent study by New School for Social Research’s Schwartz Center for Economic Policy Analysis.

“Taxing investors less is really not what the U.S. needs now,” Saez said. “Instead, we should focus on trying to rebuild middle-class wealth” by encouraging families to save for retirement and pay down mortgages.

Never mind the arguments over what’s best for the economy, though. There’s that ultimate American question about taxation we’re forgetting: What’s fair?

It’s not right, some conservatives argue, to tax investments at all. It’s “double taxation” to take a bite out of money flowing from assets that were taxed when first earned. (Technically, it’s dividends and gains that are taxed, not the original amount that’s saved, but the IRS makes no provision for inflation.)

Taxing workers more than investors is fair, conservatives also argue, because investors and workers are really the same people at different stages of their lives. When you’re young, you save and pay high tax rates on your wages. When you’re old, you get to enjoy the lightly taxed proceeds of that invested income.

The wrench in these arguments is the massive jump in inherited American wealth—driven by rising income inequality and loose tax laws. In practice, the person who successfully accumulates assets is often not the person who spends them. Affluent retirees are increasingly reluctant to even touch their nest eggs. A huge and disproportionate share of the nation’s largest fortunes is in the hands of people in their 80s and 90s. And the estate tax, already very easy for the wealthy to avoid, is targeted for elimination by the Trump administration.

As a result, an unprecedented amount of wealth may soon be inherited. The generation on the receiving end of this familial largesse will get a tax break every time they cash in on the fruits of others’ labor.

Yes, many of these lucky heirs and heiresses go to work anyway, or contribute in other ways. Still, it’s hard to argue that productive members of society—people like our ER doctor—should pay twice as much in taxes as people who sit around playing video games. But that’s the choice that underlies America’s tax code—and one that will figure in the debate over how, or whether, to rewrite it.

This article was provided by Bloomberg News.

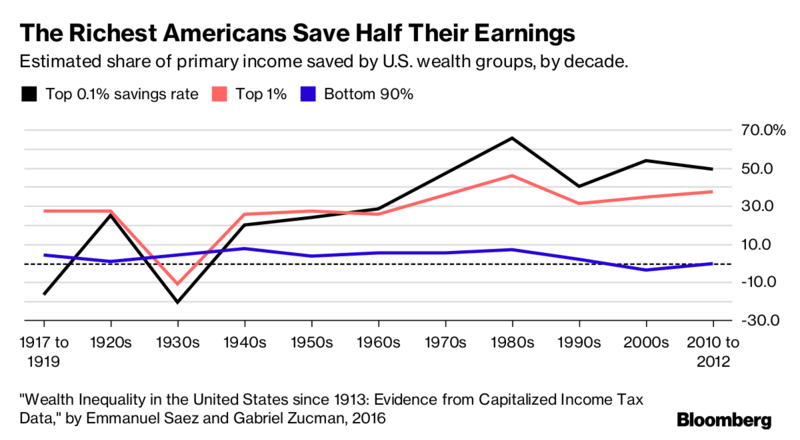

Meanwhile, the bottom 99 percent has been saving less and less—a factor contributing to growing inequality along with stagnant middle-class wages and rising debt levels.

Why American Workers Pay Twice As Much In Taxes As Wealthy Investors

September 12, 2017

« Previous Article

| Next Article »

Login in order to post a comment