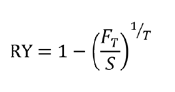

Mathematically, the roll yield (RY) can be roughly expressed as one minus the annualized ratio of the futures price (FT ) and the spot price (S):

Whether an investor is trying to benefit from backwardation or is contending with a contango curve, roll yield will be an important factor in long-term returns. However, roll yield is not equivalent to the carry from a commodity investment, and ignoring short rates when considering roll yield may lead to faulty conclusions.

Calculating Commodity Carry: The Short-Term Rate Is Key

Investments need to be compared on a like-for-like basis. With most investments, the investor must pay the full nominal price for the asset, so we think about their returns on a fully funded basis. However, investments in commodity futures are unfunded. To make meaningful comparisons with other investments, we need to look at commodities on the equivalent of a fully funded or fully collateralized basis.

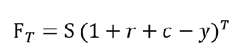

Including the short-term rate earned on the collateral investment when calculating commodity carry helps to achieve this, and it makes intuitive sense given the inputs that determine the shape of commodities futures curves (and therefore the achievable roll yield). Consider the futures equation below:

Where (FT) is today’s futures price for delivery in (T) years;

S is today’s spot price;

r is the short-term rate;