With images of Russian aggression and war crimes in Ukraine continuing to dominate the media in Europe and around the world, Germany has pledged to cut its imports of Russian gas by two-thirds by 2023. Even more immediately, Robert Habeck, Germany’s vice chancellor and minister for economic affairs and climate action, now talks of the country reducing its Russian oil imports by half by as early as this June.

Seven decades ago, Mao Zedong embraced economic self-reliance and foreign-policy militancy, which turned China into an impoverished pariah state. This history should be a stark warning to President Xi Jinping: if he allows Russia to divide the world with its war on Ukraine, it is China that will pay the heaviest price.

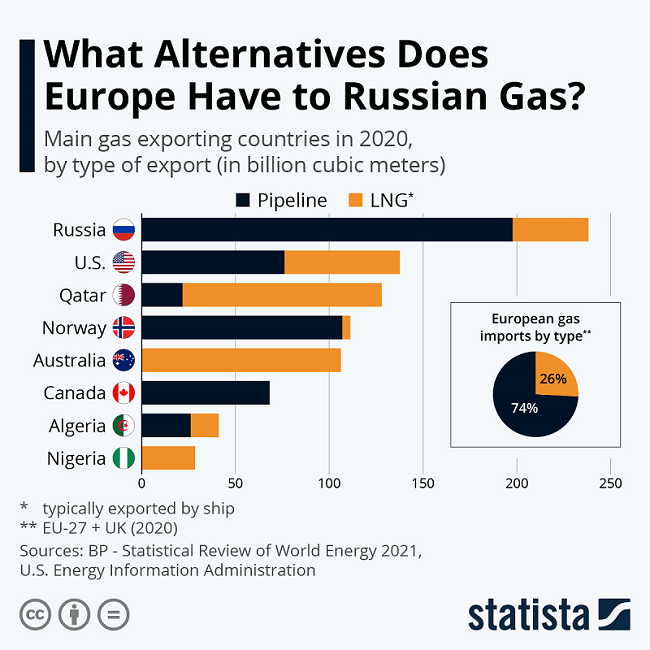

But cutting imports of Russian natural gas will take longer. The European Union recently created a new agency to buy gas on behalf of all 27 member states. Its first joint purchase, of some 15 billion cubic meters (bcm) this year, will come from the United States in the form of liquefied natural gas. But that is only a beginning.

Europe cannot quickly shift away from Russian gas, particularly in the industrial sector. Russian President Vladimir Putin’s war on Ukraine will prompt intensified efforts to develop more wind farms and solar facilities across the EU. But renewable energy requires specific improvements in infrastructure, which will take time to finance and put in place. Until battery technology allows power to be stored in substantial volumes, Europe will need gas-powered plants for backup energy supply on days without wind or sun.

Even with the 15 bcm of LNG from the US, Europe will still require another 140 bcm to replace its gas imports from Russia completely. Those supplies will have to come from a world market that was already stretched thin before Russia invaded Ukraine. And European demand for non-Russian natural gas will add to the pressure on prices for countries that depend on imports – not least China, the world’s largest gas importer.

While there is no shortage of gas in the ground, developing these resources and bringing them to market can take 3-5 years – or more if complex LNG facilities need to be installed. Putin’s war will spur the development of new gas fields, notably in the Middle East and the eastern Mediterranean. But for the time being, there is only one readily available source of substantial extra supplies: the US.

It is far from clear, however, that the US wants to be the world’s natural-gas supplier of last resort – the Saudi Arabia of the global gas market. For the US oil and gas industry and some politicians, gas exports are a rational response to global needs and a welcome new source of revenue and jobs after several lean years. They think a new shale boom beckons, because much of America’s potential gas exports will come as a byproduct of shale-oil developments.

At Finance 3.0, our latest virtual event, Jeremy Allaire, Hester Peirce, Carmen Reinhart, Raghuram Rajan, and more considered how to maximize the benefits and mitigate the risks of cryptocurrencies, digital payments, and decentralized finance.

For others, however, the promotion of gas for export represents an unwanted revival of the hydrocarbon-based economy. The gas exported from the US in the form of LNG will generate greenhouse-gas (GHG) emissions, adding to a global total that has already returned to pre-pandemic levels and is still rising.