· Potentially overly bullish gold sentiment

· Weak jewelry demand

Gold as a currency?

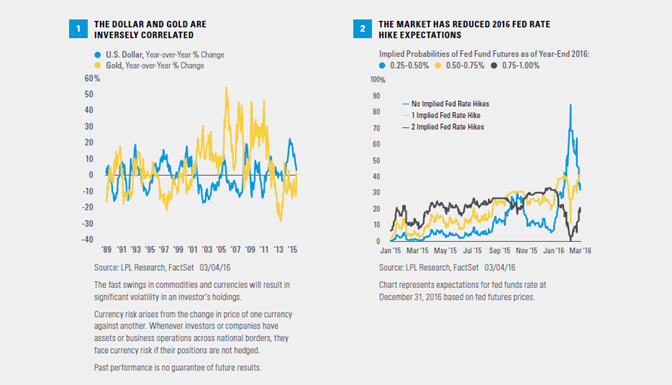

Perhaps the most widely cited gold driver is its role as a currency substitute. Given that gold is priced in dollars globally, when the dollar rises gold becomes more expensive, and vice versa. As noted in our Outlook 2016 publication, we have expected the dollar to stabilize after its big increase between mid-2014 and mid-2015. Since we issued that forecast in November 2015, as the market has pulled back some on expectations for Fed rate hikes this year, the dollar has moved modestly lower and supported gold even more than we had anticipated [Figure 1].

But rate hike expectations may have swung too far to the dovish side, with the fed funds futures market pricing in a 73% chance of no more than one hike in 2016 [Figure 2], despite the strong February jobs report (released March 4, 2016). Should the market begin to price in more rate hikes this year (or increase the probability of at least one hike), the dollar may garner additional support.

The monetary policy of other nations also influences the value of the dollar globally, a factor that may mitigate any potential dollar weakness. The European Central Bank (ECB) may cut its policy interest rate at its March 10 policy meeting (further into negative territory) and/or announce additional asset purchases, i.e., more quantitative easing (QE). The Bank of Japan (BOJ) is likely to do more as well. (See our Weekly Economic Commentary, “From Headwind to Tailwind?” for our detailed views on the dollar.)

Gold may get some support from a stable or possibly even a slightly weaker dollar, but a resilient U.S. economy suggests only marginal declines as the Fed continues with its rate hike campaign.

Gold as an inflation hedge

Inflation is another important gold driver. The biggest increases in gold prices over the past five decades came during the inflation spikes in the late 1970s before Fed Chairman Paul Volcker famously broke the back of inflation in the early 1980s. Double-digit increases in the Consumer Price Index (CPI) measure of inflation in the late 1970s and into 1980 were accompanied by a shocking quadrupling of gold prices from December 1978 through January 1980, from below $200 to over $800.