Unicorn CDs

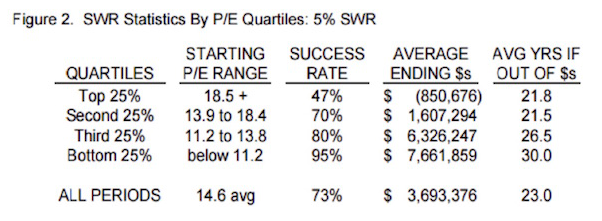

Well, that’s okay, many financial planners will say. You just dip into your principal, and when the market turns around you make it back up. I can’t tell you how many financial plans I’ve seen that assume the safe withdrawal rate (SWR) is 5%. As the table below (from one of Ed’s essays) demonstrates, a 5% withdrawal rate has historically (as in, since 1900) only been safe 47% of the time, and on average you are out of money after 21 years. Hardly safe!

The only way you can be “safe” is to find that magical 5% CD of the future when you’re ready to retire. If the world then happens to look like it does now, though, you’ll just have to keep right on working until things somehow magically recover. I hope that never happens to you, because you could find that your work experience is no longer relevant in an increasingly rapidly changing future.

I also wouldn’t assume that 30 years is a reasonable additional lifespan starting from age 65. With the advances being made in medicine and biotech, your “healthspan” as well as your lifespan are going to increase, and we are going to see many people live well into their hundreds. I think people would be well advised to plan to live a great deal longer than their parents and grandparents did and to budget for retirement accordingly. For most people that means continuing to work. If the thought of working an extra five years at your current job is somehow unpleasant, then my suggestion is that you switch jobs as soon as you can and find something you can tolerate for the longer term.

The same numbers that we applied to individual returns also apply to pension funds. Pension funds are going to wake up in 10 or 15 years, find they are massively underfunded, and look to taxpayers and businesses to re-fund them. Your corporate pension plan that is guaranteed by the Pension Benefit Guarantee Corporation is not as guaranteed as you might think. If the PBGC has to take over your fund, you may be lucky to get 50% of the promised benefits. Before you get too fat and happy, I would read the fine print on that guarantee. Then I would ask the pension plan management exactly what expected return they are planning to get; and when you hear the typical “71Ž2% for the long run (blah blah blah),” start trying to figure out how to work well past your expected retirement age so that you can supplement your pension when it fails. Then again, maybe your corporation will be there in 20 years when you need it. No need to worry – just assume it wil l all work out. Everybody else plans that way, and they all tell you everything’s going to be fine – just ask your brother-in-law.

Let’s step away from the unrestrained sarcasm to sum up the facts: Long before 20 years have passed and sometime after the onset of the next bear market, reality will set in, and pension fund managers will begin to plead for increased funding. And that is going to cause all sorts of repercussions. For a government plan, to obtain the needed funds, either taxes will have to go up, or other services and government expenditures will get cut. Either way, it appears that voters are in no mood to tolerate the status quo today. Imagine how much more fractious they’ll be in 20 years, when it’s clear that most people’s pensions are down the drain.

Governmental Bubbles

The biggest bubble in the world is the one we live in without being able to see it. It’s the bubble of government promises that government will not be able to fulfill. When it bursts, multiple generations will find their expectations destroyed. The politicians at ground zero had better be saying their prayers and putting their earthly affairs in order, because they aren’t going to last very long after that bubble bursts and reality sets in.

This is a mathematical certainty: hundreds of pensions are seriously underfunded, and many more will be endangered if we have another significant recession. Four percent returns for 10 years in a pension plan portfolio will result in massive future underfunding, even if things eventually get back to “normal.” There is going to have to be significant funding from corporations and taxpayers to make up the shortfall, at precisely the time when that money will be needed to rebuild infrastructure, retrain massive numbers of workers facing employment challenges from an ever-transforming environment, and deal with the fact that there will be more old people living than there are young people being born. This last fact is already the reality in Japan and much of Europe.

Next week we are going to look at what makes the pension challenge even more problematic: the difference between 2% GDP growth and 3% growth over the decades to come is every bit as dramatic as the difference between 4% and 8% portfolio returns. And if we don’t figure out how to get back to 3% GDP growth (and neither of the two leading presidential candidates are offering anything close to a plan that will get us there), the US is going to find itself even deeper in a hole, even as we continue to dig.

Chicago, Newport Beach, and New York

While the calendar looks relatively open (at least by past standards), the need for me to go to Chicago has arisen in the last 10 days, and suddenly it’s two days with about ten appointments. My staff decided that we might as well redeem the time while we’re there. Then after that whirlwind trip I’ll will be home for a few weeks before heading out at the end of month to Rob Arnott’s fabulous advisory council meetings, this time at Pelican Hill in Newport Beach. Those of you who know Rob and Research Affiliates know that his conference is a tad more academic than most, but he combines the intellectual heavy lifting with a fabulous food and party experience. It’s kind of like Adult Nerd Heaven. Then the following week I’ll be in New York, speaking and attending a conference.

I want to give a shout-out to my research associate Patrick Watson. Patrick went to work for me for the first time some 25 years ago, and we have worked on and off together for all the intervening time. About 10 years ago he struck out on his own and began to do research for other publishing firms, ghostwriting a lot of famous people’s newsletters and learning a great deal. With my research and writing schedule getting away from me after 15 years of Thoughts from the Frontline, I needed help. I have hired other research assistants over the years, and it has never really worked. But for whatever reason, Patrick and I really click and seem to bring out the best in each other. I know he has helped me be more productive; and given the pressure to write this next book, I don’t think I could keep all the balls in the air without him.

And speaking of the book, my research groups are beginning to put chapter outlines and research together, and most of the chapter groups are hitting their time targets. In my experience, that means we’ve come to the second most important part of the book-writing process: the no-more-excuses-not-to-begin-churning-out-copy part. The most important part, at least to my ADD brain, is when you get to the “oh-my-God-I’m-not-going-to-make-my-deadline” moment. It is actually useful when those two points coincide. In fact, now that I think about it, they almost always do. Nothing like a looming deadline and no excuses to get your derriere in gear. It helps that I am totally into the whole intellectual process of trying to figure out what the world will look like in 20 years.

Just for the record – and I’ve told my researchers this – I expect we will get a lot wrong. The future is by definition unknowable. I will be more than happy if we get the direction right. Lots of chapters will offer dual scenarios, but that’s okay. That’s not unlike what we do in business: you have your base plan, but you’re aware of all the other things that could happen that might change your operations. And hopefully the surprises are pleasant…

Before I hit the send button, I want to give you a link to Peggy Noonan’s latest essay. I think Peggy may be the finest, most powerful essayist of my generation. She thinks with clarity and writes in a fluid writing style that propels you along on her hurtling thought train, rarely ever pausing to give you a chance to get off, until you realize you’ve arrived at what should have always been your own conclusion. Young writers, if you want to know how to turn a phrase and see what writing should feel like after you’ve written it, you should study everything Peggy has penned.

If you want to write science fiction, you have to read J.R.R. Tolkien, Isaac Asimov, and Robert Heinlein. They are the masters. But if you want to write political essays and persuade people to a point of view – and do so in an aggressively literate yet polite manner, you read Peggy Noonan.

Her latest essay, “Trump and the Rise of the Unprotected,” talks about how Trump has managed to collect his diverse and burgeoning following. It is not within the experience of the establishment political class to comprehend what is happening. This phenomenon is more than just Tea Party.

I’ve been involved in the political wars for some 40 years. I’ve seen the back and forth between voters and politicians. This time around, I’ve talked to friends all over the country who do not fit the stereotypes the media has painted of Trump supporters. They are articulate, educated, and successful. They are also frustrated as hell with politics as usual. There are only a few times in American history that even vaguely rhyme with the time we’re in – I think what we’re seeing is unique. When you add the current frustrations of American voters to those of European voters, particularly around the issue of illegal immigration, you come up with real potential for profound change in the world geopolitical scene over the next five or ten years. It’s certainly something to think about, and Peggy sets a great thought table.

The political analyst in me looks at the record-high unfavorable rating for Donald Trump as a national candidate and then looks at Hillary Clinton and sees the same thing. I have a feeling this election cycle could be more negative and downright ugly than any I’ve seen in my lifetime – and that’s saying something. And given the mood of the country, it’s impossible to know what the outcome will be. We are truly in no man’s land here – but hey, it promises to be an adventure.

It really is time to hit the send button. You have a great week and find time to read something fun.

Your trying to wrap his head around the words President and Trump in the same sentence analyst,

John Mauldin

Follow John Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts from the Frontline. The publication explores developments overlooked by mainstream news and analyzes challenges and opportunities on the horizon.