An important debate has emerged about one of the biggest mega trends of this century: Does the explosive growth of the aging population present an opportunity or risk for investors with a medium to long-term investment horizon?

We are talking about seismic shifts that will play out over several decades, and leading companies and investors are positioning themselves for 21st century longevity opportunities with the potential to create new markets and economic growth. For the first time in history, 65-year- olds outnumber 15-year-olds; the elderly population in several developed countries will double in 20 years. This is also a wealthy population. Nearly 70 percent of disposable income will soon be in the hands of Americans over 60.

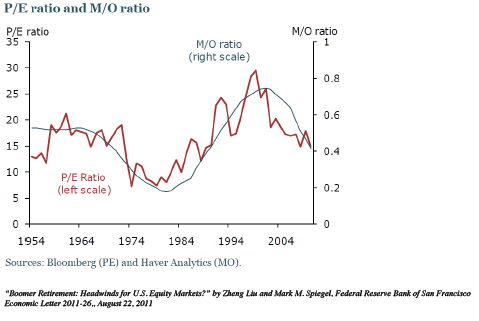

Less discussed are the investment risks posed by aging. For the bear case, consider the United States Federal Reserve Bank of San Francisco’s analysis, "Boomer Retirement: Headwinds for U.S. Equity Markets?" To examine the relationship between demographics and stock prices, Fed economists compared equity price / earnings (P/E) ratios with the so-called M/O ratio, which measures Middle-age population cohort aged 40-49, relative to the Older cohort aged 60-69. Between 1981 and 2000, when baby boomers were at their peak working and saving years, the M/O ratio quadrupled and P/E ratios for the S&P 500 tripled to 24x. Since the early 2000s, M/O and P/E ratios have declined, and the model predicts a downward trend until 2025 when demographics are more supportive of stock valuations.

Chart 1: U.S. Equity Values Closely Related To Population Age Distribution