Although we remain positive, we expect elevated volatility to persist due to global growth concerns and central bank policies—including an uncertain Federal Reserve timeline and divergent courses among global central banks. Fiscal policy is likely to remain a focal point of market anxiety, with the U.S. election among the factors figuring prominently in this regard.

We believe the U.S. and global economies are likely to maintain a muted pace of expansion over the near term. The U.S. consumer remains strong, key data points in the euro zone have shown improvement, and China has many tools to avoid a hard landing. Fiscal policy remains a headwind to more robust expansion, with overregulation among the factors challenging entrepreneurship and business growth in a number of economies, including the U.S.

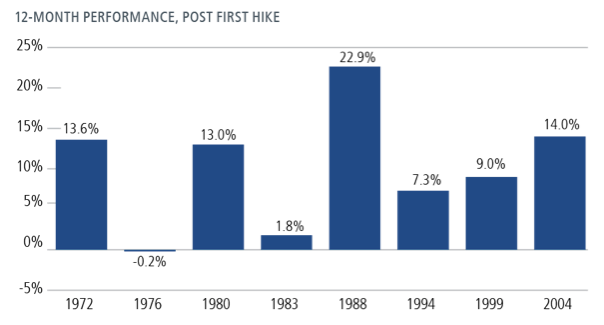

Whenever the Fed increases rates, it will be a sign of the overall health of the U.S. economy and an affirmation that the global economy is sufficiently stable. Also, any interest rate increases will likely follow a slow and shallow path.

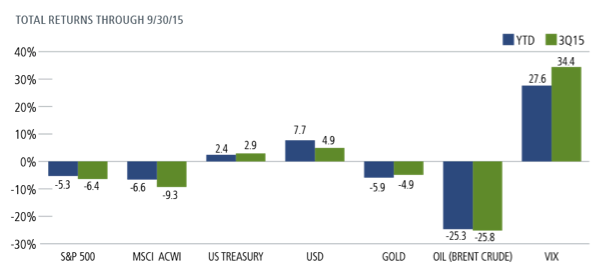

FIGURE 1. 3Q 2015, VOLATILITY SOARS, EQUITIES AND COMMODITIES FALTER

Past performance is no guarantee of future results. Source: Bloomberg.

FIGURE 2. S&P 500 RETURNS AFTER RATE HIKES

Past performance is no guarantee of future results. Source: Cornerstone Macro. “Positioning For A Fed Tightening Cycle,” September 16, 2015. The third quarter proved difficult for investors as apprehension about slowing global growth and monetary and fiscal policies converged. As Figure 1 shows, volatility soared while equities declined sharply and commodities plummeted. Heading into the final months of the year, our positioning is cautious, but reflects our view that the markets offer many opportunities, particularly among growth-oriented equities and convertibles, along with high yield.

The third quarter proved difficult for investors as apprehension about slowing global growth and monetary and fiscal policies converged. As Figure 1 shows, volatility soared while equities declined sharply and commodities plummeted. Heading into the final months of the year, our positioning is cautious, but reflects our view that the markets offer many opportunities, particularly among growth-oriented equities and convertibles, along with high yield.

A Cautious Yet Positive Outlook

November 3, 2015

« Previous Article

| Next Article »

Login in order to post a comment