Conclusions

➜ The so-called Endowment Model failed in 2008, yet investors continue to cling to the framework and ignore that the macroeconomic backdrop that fueled much of the Endowment Model’s success has significantly changed.

➜ Asset Allocation 2.0 is a different method for allocating assets. Rather than relying on traditional asset categories, it seeks to exploit sensitivities or characteristics within the global financial markets.

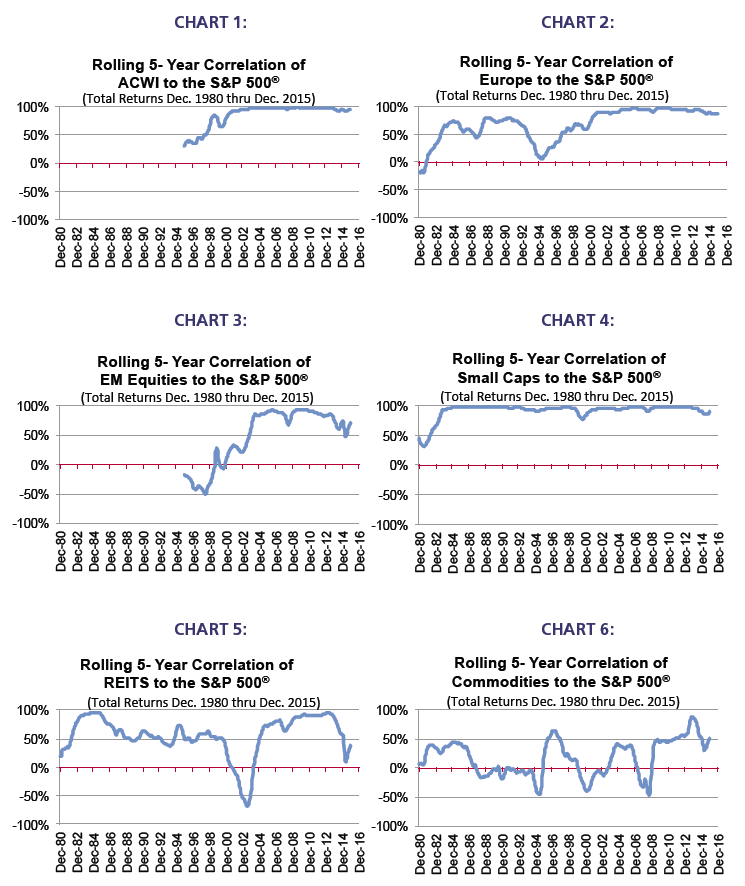

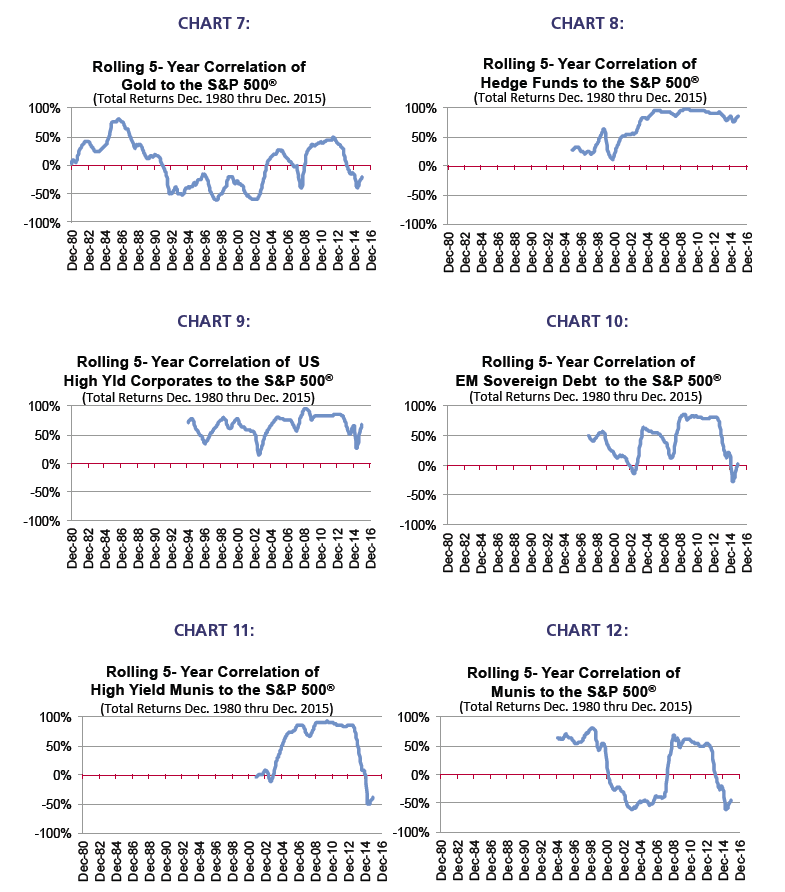

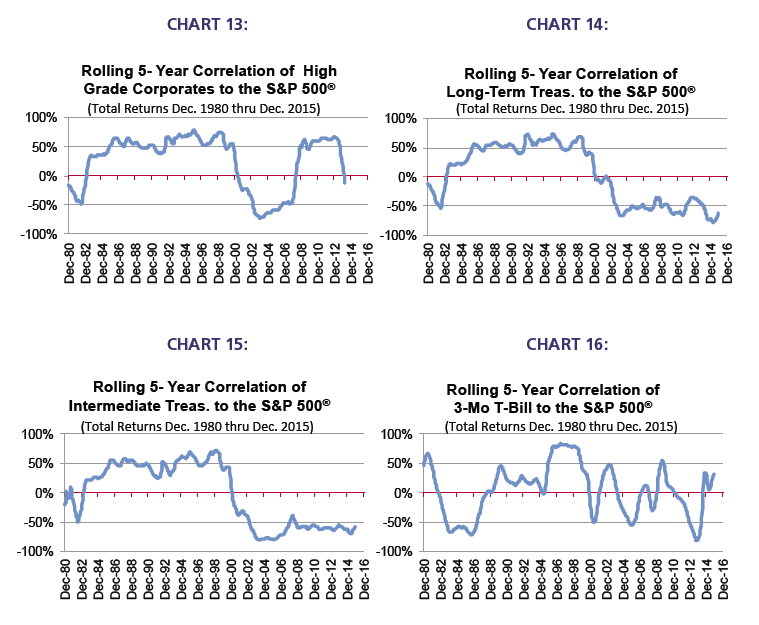

➜ Traditional correlation analyses can be manipulated and should be used judiciously. Secular correlations seem much more useful.

➜ There is a spectrum of sensitivities. Investors need to judge the cost/benefit of gaining exposures to those sensitivities.

➜ Asset Allocation 2.0 is a dynamic process that removes the traditional asset allocation boundaries to search for the most effective way to gain factor exposure.

If you would like to learn more about RBA’s Asset Allocation 2.0, please contact your RBA Portfolio Specialist.

Source: Richard Bernstein Advisors LLC, Standard & Poors, BofA Merrill Lynch, HFRI, MSCI, Bloomberg Finance L.P.

For Index descriptors, see "Index Descriptions" at end of document.

INDEX DESCRIPTIONS:

The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website.

The past performance of an index is not a guarantee of future results.

Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur transaction costs, which would lower the performance results. Indices are not actively managed and investors cannot invest directly in the indices.

Gold: Gold Spot USD/oz Bloomberg GOLDS Commodity. The Gold Spot price is quoted as US Dollars per Troy Ounce.

Commodities: S&P GSCI Index.The S&P GSCIR seeks to provide investors with a reliable and publicly available benchmark for investment performance in the commodity markets, and is designed to be a “tradable” index. The index is calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets.