Does international bond exposure belong in a target date fund (TDF) today? It’s a fair question in an investing environment where any potential source of portfolio return is getting a fresh look.

We believe, however, that the answer is a resounding no – and that any benefit to adding international bonds is considerably outweighed by the potential risks.

TDFs are complex solutions designed to balance a wide range of market conditions. As the dynamics shift and asset classes evolve, questions can emerge about whether a fund’s current “glidepath” – that is, its asset allocation over the years leading up to the targeted retirement date – remains appropriate for achieving the fund’s objective.

In particular, the question of whether adding international bond exposure to TDFs will improve diversification and generate stronger risk-adjusted returns has been a popular discussion point. We have looked at the question in depth, as part of our ongoing process of systematically evaluating inclusion of various asset classes including global and international bond exposures, in our firm’s TDF suite - LifePath®.

Even within our current capital market assumptions, our view is that adding international bonds does potentially improve diversification. However, the bonds also may introduce uncompensated currency risk and additional costs that act as a drag on performance, may increase exposure to countries with less financial stability, and will not meaningfully improve risk-adjusted returns.

Let’s take a look first at the diversification case for international bonds.

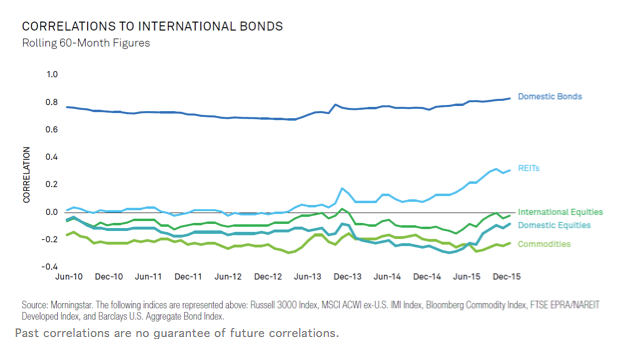

As the chart below illustrates (10-year data), returns for international bonds have exhibited low correlations to many broad asset classes, an effect that has held true for both currency hedged and unhedged exposures. There is no question that increased diversification is attractive, but the key question is whether the potential benefits can be captured in a cost effective manner.

When we take a look beyond the apparent diversification benefit, potential issues clearly emerge.

Uncompensated Currency Risk

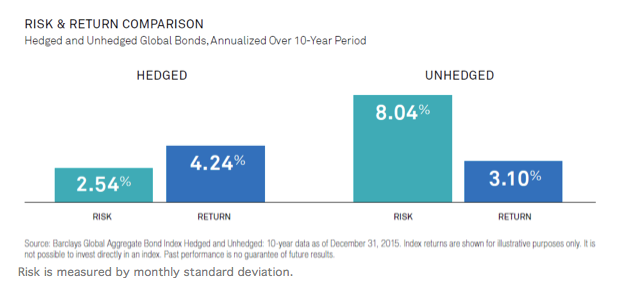

Over the past 10 years, currency volatility has represented about half of the total risk in the Barclays Global Aggregate Index. The impact is large, given the relatively low levels of absolute return generated by bonds. In the short term, currency exposure can be very volatile, but over longer time periods the expected return on currencies is zero. Accepting currency volatility is an uncompensated risk – which means that adding global bonds to a TDF introduces a generally uncompensated risk into that fund. That, in turn, drives the question and potential complexity of currency hedging.

Higher Transaction and Hedging Costs

Accessing global bonds remains relatively more expensive than transacting domestic investment-grade bonds due to lower liquidity and lack of transparency in the international bond markets. Currency hedging introduces additional cost (as well as complexity), which is estimated to be about 0.15% annually, rising during times of market stress. This added expense may be a drag on returns, eroding some of the modestly improved risk-adjusted return assumptions discussed above.