Lack Of Excess

Volatility abounds across the globe, with fears of major economies breaking down dominating investors’ attention and headlines. Recession risk is up, but not likely to the degree fears are up. Drivers of recessions and bear markets have been varied in the past, but they typically come when excess has built in the economy—typically in spending, lending, inflation, and/or monetary policy.

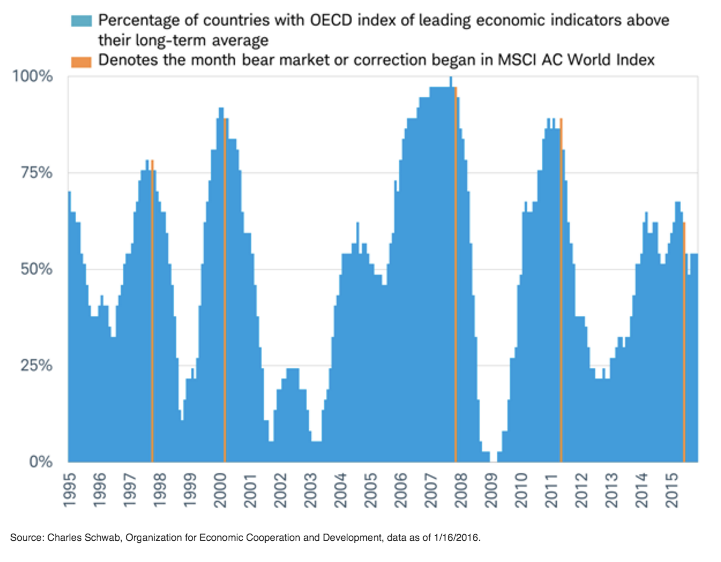

The International Monetary Fund has used a global annual real gross domestic product (GDP) growth rate of 3.0% or less as a guideline for defining a global recession. Using that guideline, over the past 20 years there have been four global recessions. As each of the downturns began, global stocks fell into bear markets, measured as a 20% or more decline from the peak in the MSCI All-Country World Index. As you can see in the chart below, one way to see the start of these bear markets is by the peaks in the percentage of countries with their index of leading economic indicators above the long-term average.

Leading Economic Indicators And Bear Markets

In recent years, global growth has not been as strong nor as widespread as it had been in past periods of growth. This may mean that the build up of excesses and imbalances that ultimately lead to a global recession have not yet reached a level that makes the global economy vulnerable to a prolonged downturn.

Market Overshoots

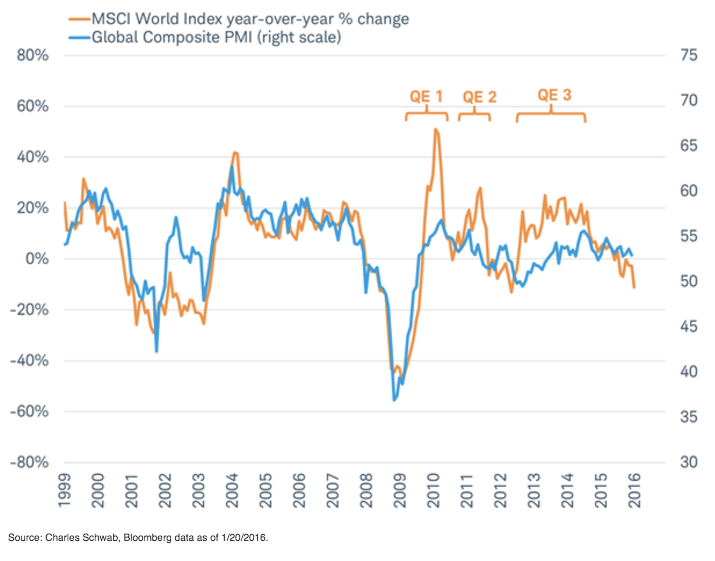

The overshoot to the downside in global markets relative to the global economy can be seen in the chart below. The world’s stocks tend to closely track the global composite purchasing managers index, a measure of global economic activity. The exceptions were when the Fed’s QE programs temporarily boosted stocks without a similar effect on the global economy. Stocks have priced in a drop from the December reading of 52.9 to just below 50, a level coincident with global recessions in the past.

Global stocks overshoot global economy

While global stocks markets are increasingly pricing in fears of a prolonged global recession, the global economy has yet to weaken significantly or reflect excesses that make it especially vulnerable to the risks posed by falling oil prices, slowing Chinese economic growth, or a slow and measured pace of Fed rate hikes.

So What?

It can be difficult to stay calm during market declines, but reacting emotionally is rarely beneficial. Investors need to maintain discipline and keep long-term goals in mind. Risks have risen for the U.S. and global economy, but neither a domestic nor global recession appears to be on the imminent horizon. But oil likely needs to stabilize to stem some of the recent volatility. Stay calm, and don’t overreact to the short-term gyrations in the market.

Liz Ann Sonders is senior vice president and chief investment strategist at Charles Schwab & Co.

Brad Sorensen is managing director of market and sector analysis at the Schwab Center for Financial Research.

Jeffrey Kleintop is senior vice president and chief global investment strategist at Charles Schwab & Co.

This article can also be read here.