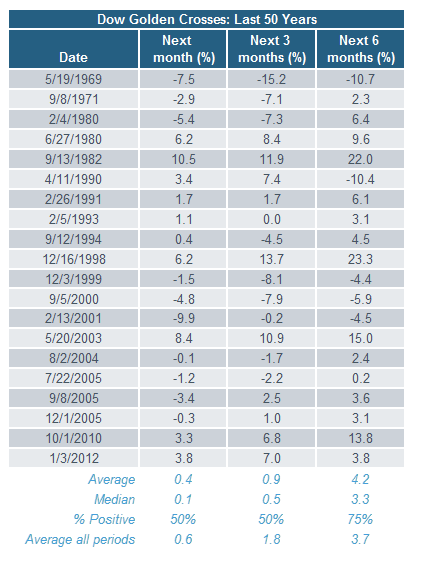

Bespoke Investment Group (BIG) took a look at the past 50 years to see how the market fared in the aftermath of Golden Crosses. As you can see by looking at the average and median returns at the bottom of the table below, performance following Golden Crosses was no better than the performance over any random time period. It was up exactly half the time over the next month and three months; while returns and probabilities did increase for the six-month period.

Source: Bespoke Investment Group (BIG), as of April 22, 2016.

If you are looking for the glass-half-full perspective, do note that the Dow performed very well following the last two Golden Crosses in October 2010 and January 2012; while the Dow was positive in the six months after the last seven Golden Crosses as well.

Also on the subject of 200-day moving averages

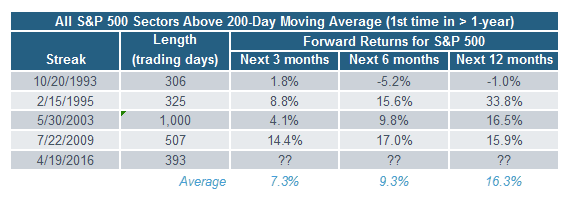

Another feat by the market last week was the continued improvement in market breadth (which has been much healthier than other rallies over the past year). Last week, the Financial sector finally regained its 200-day moving average, which now puts all 10 S&P 500 sectors above their 200-day moving averages.

The recent streak of over a year without all 10 sectors above their 200-day moving averages simultaneously is rare. According to BIG, there have only been four previous streaks of a year or more since 1990; and two of those were coming out of major bear markets. As you can see in the table below, this sign of improving breadth was an extremely bullish signal in three of the past four instances (1993 had mixed results).

Source: Bespoke Investment Group (BIG), as of April 22, 2016.

Competing forces

The net is that there are competing forces at work for the market at present. From the February low, the market has rallied sharply, which has triggered indicators like the Golden Cross. BIG looked back over the Dow’s entire history to find times when the Dow closed at a 52-week low at some point in the prior three months, then rallied at least 13% over a 50-day period. The last two times this occurred were in October 2011 and November 2015—both marked short-term highs in stocks.

However, the current experience is unusual because it’s the second occurrence within a year. The other times that happened (November 1900, October 1921, July 1932 and November 2001), stocks did markedly better.

To me, these conflicting forces suggest maintaining our “neutral” rating on U.S. stocks. That means investors should remain at their strategic equity allocation, but be extra mindful of adopting rebalancing strategies in the interest of risk control.

Liz Ann Sonders is senior vice president and chief investment strategist at Charles Schwab & Co.

Sign O’ The Times: Sell In May And Go Away?

April 26, 2016

« Previous Article

| Next Article »

Login in order to post a comment