Given our outlook for muted growth, we are favoring quality growth names over cyclicals. We have sought to increase the balance sheet strength of the companies in which we are investing, continuing to seek out names with high returns on invested capital. From a thematic and sector perspective, we see opportunities in the technology sector, consumer companies tied to middle class spending, and companies positioned to benefit from improving fundamentals in Europe. We’re more cautious about companies that are vulnerable to regulatory headwinds (such as pharmaceuticals) and companies that are more exposed to the U.S. cap-ex cycle.

Emerging Markets. Although China’s recent manufacturing data and equity market turmoil have roiled the global markets, we believe a hard landing is unlikely. China has many tools at its disposal as it charts a multi-decade course to a more balanced economy. Over recent months, the government has announced fiscal measures to combat slowing growth but, as we have noted, these will take time to make their way through the economy. Within this context, the present weakness in manufacturing PMI is not entirely unexpected, while relatively stronger PMI for the services sector (still indicative of expansionary levels) and retail sales data support a more constructive longer-term outlook.

In regard to our positioning more broadly within the emerging markets, we remain extremely selective. Without a significant global cyclical pick-up and corresponding improvement in global trade, we expect many EMs will remain under pressure. However, there are still opportunities. From a top-down perspective, we are emphasizing countries that are net commodity importers, those that are pursuing economic reforms, and/or have stronger consumers, reduced current account deficits, and are benefiting from secular themes. Our most favored EM countries include the Philippines, India, Vietnam, Mexico and China. From a bottom-up perspective, we believe companies with strong balance sheets and high or accelerating return on invested capital (ROIC) are most likely to outperform in this environment.

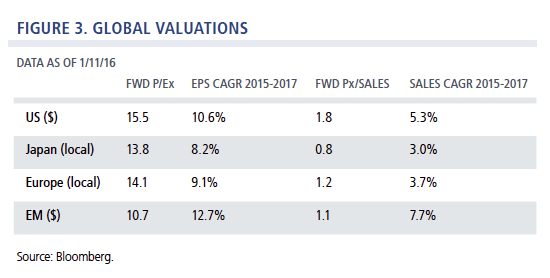

Europe and Japan. Our view on opportunities in Europe is positive, particularly as the European Central Bank looks set to take the baton from the Bank of Japan as the most accommodative central bank in the world. We are seeing strong momentum, resilient-to-improving economic fundamentals, as well as attractive valuations relative to other regions (Figure 3) and a positive liquidity environment. These factors, as well as a weakened euro and the ECB’s quantitative easing have led us to overweight Europe in our global and international strategies. We maintain a focus on growth-oriented companies, including beneficiaries of asset reflation and export opportunities afforded by a weaker euro.

While Japan’s economy remains lackluster, we continue to identify a number of bottom-up opportunities. Japanese valuations are not as compelling as they were a year ago, but given our expectation that we will see an improvement in ROIC for many companies we are investing in, we are finding better relative value. In many instances, this improvement is coming both from an improvement in margins and more efficient use of capital—both of which are creating intrinsic value for shareholders.

Convertible Securities. We are constructive on the convertible market as we enter 2016. Convertibles have historically performed well during rising rate regimes, and even if the Fed pursues rate increases at a more tempered pace, we anticipate a positive backdrop for the asset class. Our positioning reflects a growth bias, as we continue to emphasize opportunities within information technology, including cloud computing, data center disruption and consumer-related services. We also favor the consumer discretionary sector, including companies disrupting the traditional auto market and those positioned to benefit from a healthy U.S. consumer. We have become more selective within health care, particularly among companies that may be especially vulnerable to increasing regulatory and political pressures as the U.S. election nears. We are also highly cautious about cyclical sectors as fundamentals continue

to weaken.

Similar to the broader equity markets, we see a bifurcation in the underlying convertible equity valuations with portions more richly valued than others. We are maintaining our focus on convertibles with more balanced equity and fixed income characteristics, given the high level of market volatility we anticipate. In regard to more credit sensitive structures, we are favoring higher quality balance sheets and/or companies that we believe are positioned to improve their credit profiles.

Globally, new issuance for 2015 was healthy, ending the year at just above $80 billion. Issues came to market with generally favorable terms and we saw strong representation from the technology and health care sectors. In the U.S., approximately half of the new issuance came in the form of mandatory convertible structures, which was higher than in the recent past. Because mandatory structures do not provide as much downside protection as traditional convertible bonds, we have been selective in our participation, particularly within cyclical sectors such as energy where fundamentals continue to weaken.