There are potential pitfalls regarding efforts to increase taxable income as a part of managing taxes for long-term efficiency in retirement. These pitfalls make the process more complicated as there is more to pay attention to than just the federal or state income tax brackets. Taxable income can uniquely generate a need to pay taxes on more of Social Security benefits and can raise Medicare premiums. It can also trigger the net investment income surtax. After 2026, it may lead to phase-outs for personal exemptions and itemized deductions. In special cases, there could also be additional tax deductions and tax credits with income limits that could be lost. For those retiring before Medicare eligibility, taxable income could also impact the availability of subsidies for health insurance coverage. Here we will emphasize a few of these key issues. Perhaps the most important of these for typical retirees will be the Social Security tax torpedo and the Medicare IRMAA surcharges.

The Social Security Tax Torpedo

Having more income can uniquely generate a need to pay taxes on Social Security benefits. Up to 85% of Social Security benefits can be counted as taxable income. The rules for Social Security benefit taxation create what is known as the “tax torpedo.” Once benefits begin, each $1 of additional income from qualified plan distributions and the like will require taxes on that income as well as taxes on up to 85% of a corresponding $1 of Social Security. Wealthier individuals may find that avoiding taxes on 85% of Social Security benefits is impossible, but those with relatively more modest resources might be able to set into motion a plan that can reduce or even completely avoid the tax torpedo for life, while following conventional wisdom strategies could leave them mired in paying more taxes through the torpedo. Presently around 50% of Social Security beneficiaries will pay taxes on at least a portion of their Social Security benefits.

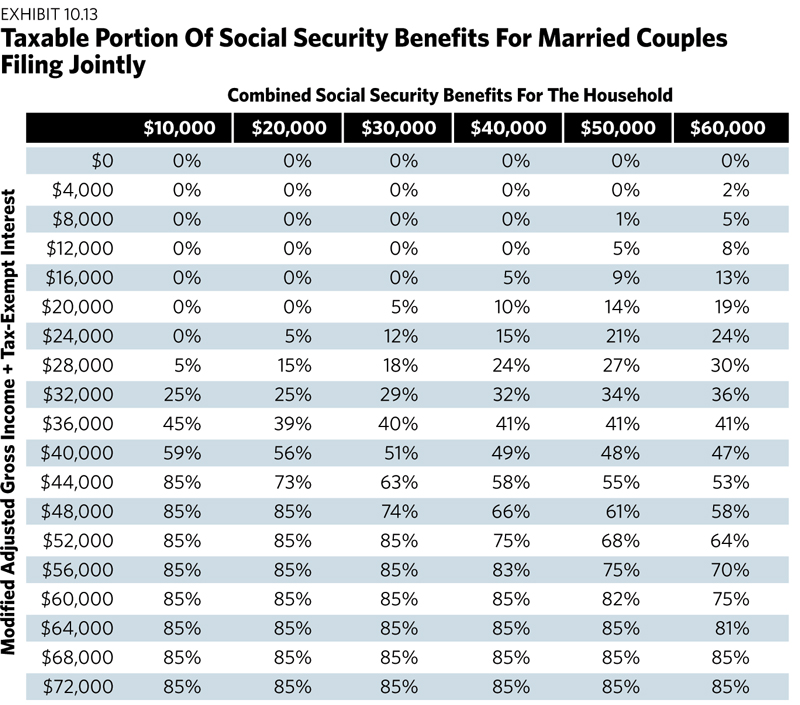

Exhibit 10.12 provides the details for determining how much of Social Security benefits are taxable. The calculation is based on provisional income, which is defined as modified adjusted gross income (MAGI) plus half of the Social Security benefits plus any tax-exempt interest from investments such as municipal bonds. Depending on the publication, this provisional income measure may also be called the combined income or the total income. As well, modified adjusted gross income can mean different things each time it is mentioned in the tax code. In this context, it is generally the components of adjusted gross income listed on the 1040 tax form before including the taxable portion of Social Security benefits. This calculation is what determines how much of the Social Security benefits are taxable, which then allows for the calculation of AGI.

The dollar values in Exhibit 10.12 were set in 1994 and this is one part of the tax code that is not adjusted for inflation. Congress may change these thresholds at some point, but they have been the same for a long time. This means that over time more and more Americans will pay income tax on their Social Security benefits unless they have built up large non-taxable reserves. The upper thresholds for triggering taxation on 85% of benefits are $34,000 for single filers and $44,000 for joint filers.

Calculating taxable Social Security benefits is complex because of these loopy formulas. You do not know your AGI until you know how much of your benefit is taxed, but you do not know how much of your benefit is taxed until you know your AGI. The amount of Social Security benefits that are taxable is calculated as whichever of these three calculations provides the smallest amount:

1. 85% of Social Security benefits

2. 50% of Social Security benefits plus 85% of the amount of provisional income that exceeds the second threshold ($34,000 for singles and $44,000 for joint filers)

3. 50% of provisional income beyond the first threshold plus 35% of provisional income beyond the second income threshold

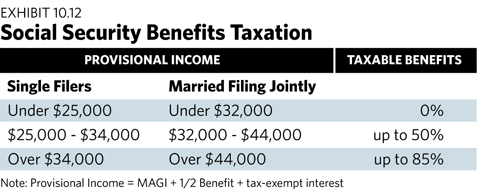

These three calculations can create results that may not be intuitive. It also becomes difficult to connect taxable income directly to the marginal tax rates because the results vary by amount of Social Security benefits. There is not just one tax torpedo; its shape is different for different amounts of Social Security benefits. To provide a sense about this, Exhibit 10.13 shows the taxable portion of Social Security benefits for couples who are married filing jointly. The results are shown for different components of the provisional income (Social Security benefits and everything else). Perhaps the most counterintuitive outcome relates to how the taxable portion of Social Security benefits can decrease as the Social Security benefit increases for different levels of MAGI and tax-exempt interest. This is because the taxable portion of the benefit is not growing as fast as the benefit in those cases where the 85% rate is playing a role.

For Exhibit 10.13, the tax torpedo is at work in any case that taxable Social Security benefits are greater than 0% and less than 85%. When the taxable portion is still 0%, a dollar of additional income does not trigger tax on Social Security. Once the taxable portion becomes 85%, then a dollar of additional income does not trigger more Social Security taxes. But for the range in between, the tax torpedo is at work as more income triggers not just taxes on that income but also taxes on more Social Security benefits.