Increased Medicare Part B and Part D Premiums

Another part of the tax code that can create tricky planning implications relates to how Medicare Part B and Part D premiums are determined. This is known as the Income Related Monthly Adjustment Amounts (IRMAA) for Medicare premiums. The level of premiums paid depends on modified adjusted gross income, which in this context is defined more simply as adjusted gross income plus tax-exempt interest. Note again, as with Social Security, that while tax-exempt interest is not taxable, it can generate higher taxes on other sources of income. An additional issue for Medicare, though, is that the relevant measure of MAGI is from two years prior, which is what you have stated on your prior year tax returns. For example, determining Medicare premiums in 2021 means using the MAGI from 2019 included on your 2020 tax forms. For those starting Medicare at 65, this means that tax planning begins accounting for impacts on Medicare premiums at age 63. For those experiencing life-changing events that lower current year MAGI relative to two years prior, which does include retiring, it is possible to file a petition with form SSA-44 to have a smaller premium applied. It is important to note that Roth conversions are not considered as a life changing event and any higher premiums a Roth conversion generates should be viewed as an additional tax.

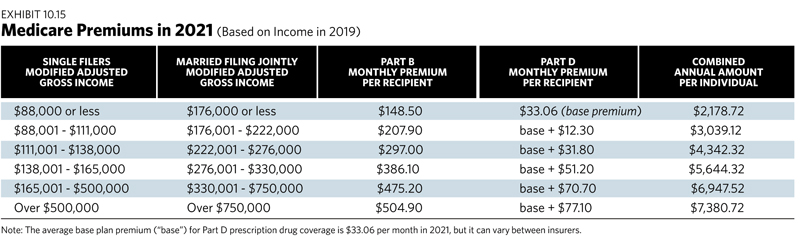

Exhibit 10.15 provides the details for 2021 Medicare Part B medical insurance and Part D drug coverage. It shows the MAGI income thresholds for a single and for a married-filing-jointly couple as the associated monthly premiums and combined annual values. These are per-person premiums, which doubles the cost for a couple who are both enrolled in Medicare. The costs for Medicare can increase in quite noticeable ways at higher income levels. And it is important to understand that these thresholds are firm. A single person with a MAGI of $88,000 would experience annual premiums of $2,179. With one more dollar of income ($88,001), the annual premium jumps by $860 dollars, representing an 86,000% marginal tax rate on that dollar. This effect gets even larger at other thresholds, and with couples the premium jump is multiplied by two. This is a more extreme type of tax torpedo, and those who are using tax bracket management as part of tax planning should take care to make sure that the MAGI does not exceed a particular threshold by even $1. Leave yourself a buffer for surprises with tax projections that get you close to any of these thresholds. Because these tax brackets are significantly higher than with the Social Security tax torpedo, this issue will affect fewer retirees, but it is important to monitor for Roth conversions.

The Retirement Planning Guidebook is designed to help readers navigate the key financial and non-financial decisions for a successful retirement. The book includes detailed action plans for decision making that can assist advisors and their clients.

Wade D. Pfau, Ph.D., CFA, is the curriculum director of the Retirement Income Certified Professional program at The American College in King of Prussia, Pa. He is also a principal and director at McLean Asset Management and RetirementResearcher.com. His book, The Retirement Planning Guidebook, is designed to help readers navigate the key financial and non-financial decisions for a successful retirement. The book includes detailed action plans for decision-making that can assist advisors and their clients.