In Brazil, labor reform passed earlier this year gives companies more flexibility in managing their workforce, potentially leading to lower labor expenses. India has seen some of the most substantial reform progress among EMs, kicked off by Prime Minister Narendra Modi’s election in 2014. Demonetization last November removed a big chunk of cash from circulation in an effort to crack down on tax evasion and corruption.

Another area of focus for the Indian government: digitization of the financial system. Initiatives have included opening roughly 300 million bank accounts for unserved populations over the past three years, and setting up electronic transfers of subsidies and government payments in an effort to support consumption and reduce wasteful spending. Landmark tax reform introduced in July to improve receipts and reduce tax evasion has brought an influx of new registrations to the tax system. Our calculations suggest the country could see a $50 billion boost in receipts annually, raising its low tax-top ratio about two percentage points by 2020.

Company margins have been challenged as the government has undertaken these reforms, but are slowly showing signs of improvement amid lower expenses and inflation. Earnings growth has picked up to more than 10 percent for 2017, according to Thomson Reuters data, and consensus estimates call for 21 percent in 2018, the highest of any major market. Equity markets in India have seen record inflows from domestic investors, at nearly $23 billion through September of this year, according to the Association for Mutual Funds in India.

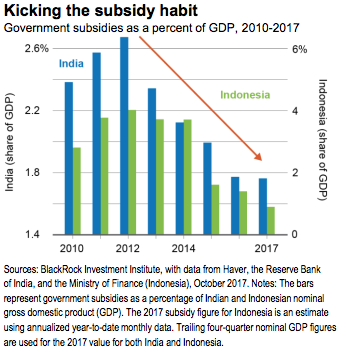

Reform progress is supporting Indonesia’s equity market as well. Government subsidies, mostly on fossil fuels, have fallen two-thirds from a 2012 peak of over 5 percent of GDP. See the Kicking the subsidy habit chart. This frees up funds for spending on infrastructure and lays the groundwork for higher domestic investment.

Indonesia’s currency has weakened over the past five years, but the export benefits have yet to be fully realized. The ease of doing business has improved and household debt as a share of GDP is low compared with some of its Southeast Asian peers. Indonesian equities have lagged both EM broadly and EM Asia, and we believe there may be room for catch-up. Our stock picks here: banks, for their attractive valuations, as well as infrastructure such as tollroad operators and power companies

The Role Of Monetary Policy

Our Growth GPS points to the second EM support: synchronized global growth. The third leg of that support system is monetary policy. Many EM central banks are able to cut policy rates even as the Fed normalizes and other DMs weigh cutting back accommodation. We calculate seven major EM central banks, including Brazil’s and India’s, collectively delivered more than 1,000 basis points in rate cuts through

October of this year. Mexico was the only major EM central bank to increase rates in 2017. DMs are heading in the other direction. The key reason for the divergence: EM disinflation.

Case in point: Brazil’s inflation rate has tumbled from 10.7 percent at year-end 2015 to 2.5 percent today, according to Haver Analytics. And rate cuts have been dramatic, with the central bank’s Selic rate dropping over the past 12 months from 14.25 percent to 7.50 percent, its lowest since 2013. We see rates ending the year at 7 percent, with another 50 bps of easing in the first quarter of 2018. In India, central bank policy rates of 6 percent are their lowest since 2010, while Haver data show inflation has declined from 13.4 percent in January 2010 to 3.3 percent now. The upshot for equities: Reduced cost of funding supports the corporate sector and should stimulate spending and investing.