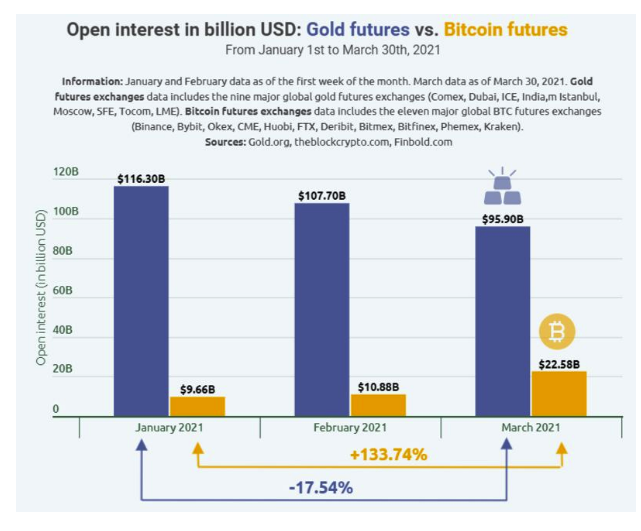

There is one other element to bring in. Gold has new competitors in the cryptocurrency space. Like gold, bitcoin and the like appeal to people who want to bet not only on weakness in fiat currencies that will show up through inflation, but also to show their disapproval of government and its growing powers. Bitcoin continues to be one of the remarkable stories of the age, and it would make sense if it were at the margin taking demand away from gold. These numbers come from the Finbold website and suggest that trading volumes in bitcoin futures are rising fast while trading in gold has declined:

Another crash for bitcoin, very easy to imagine, would probably be good for gold.

Where does all this leave us? For those who think that the bond market has given us a head fake, and that yields will consolidate or even fall over the next few months and years, gold looks like an interesting way to play that. If the inflation scare takes greater hold and 10-year real yields rise, gold looks at risk of a true bear market. But, as in August, nothing matters more than how the economy emerges from the pandemic and the resulting effect on bond yields.

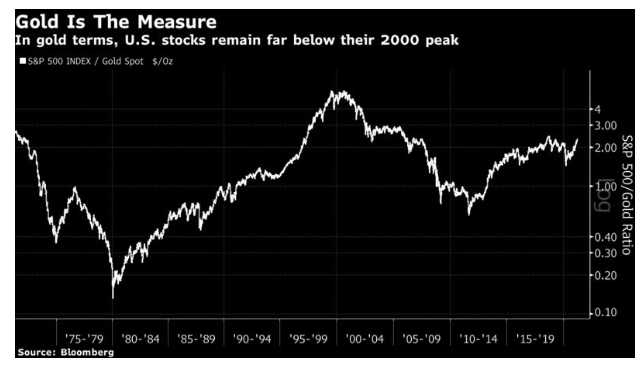

Gold Is The Measure

The financial history of the last half-century becomes much simpler. A horrific bear market takes hold throughout the 1970s, amid oil shocks and stagflation, to be followed by a scarcely interrupted two-decade-long bull market that finally went too far amid the internet boom. After that came a savage bear market that only reached bottom after the debt ceiling crisis of 2011, when investors grasped that the Fed’s quantitative easing bond purchases weren’t going to cause inflation. Since then there has been another bull market, though so far much slower than the one that preceded it. All of this coheres very well with subjective impressions of how financial conditions felt at the time.

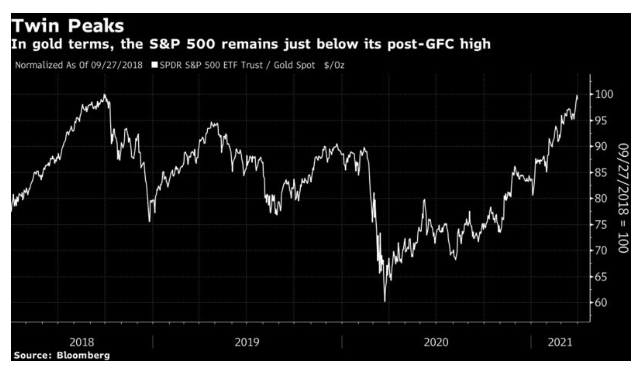

Are we still in a bull market on that basis? Probably, but the final day of the quarter produced an interesting quirk. With the gold price rallying, the S&P in gold terms fell slightly, leaving it just short of the post-dot-com high set at the end of September 2018.

How important is this measure? A lot can get clouded with political preconceptions. Depending on your point of view, gold is the ultimate measure of everything, or an illiquid and irrelevant relic whose value is in the eye of the beholder. But both numerator and denominator in the S&P/gold ratio are dependent to a great extent on bond yields, with stocks weathering higher yields much better than gold has done to date. Barring seriously bad news on the pandemic, it’s fair to expect the S&P in gold terms to take out its 2018 high before long.

It’s always interesting to look at the stock market in terms of gold. In the long run the ratio between the two, one benefiting from risk appetite and the other from aversion, speaks volumes about the financial and market regime in which we find ourselves. This is how the S&P 500 in gold terms (the ratio of the S&P to the gold price) has performed over the last 50 years—since just before the collapse of the Bretton Woods exchange-rate regime, which allowed gold to vary against the dollar: