Infrastructure Day

It looks like Infrastructure Day has finally arrived. President Joe Biden, an old man in a hurry, is moving quickly to assert his political advantage with a proposal for a $2.1 trillion splurge of infrastructure spending, financed in part by increasing corporate taxes. Anyone who has tried to travel around the U.S. in recent years will know that there are plenty enough worthwhile projects to justify that massive sum. And anyone who has observed the attempts to finance infrastructure projects across the world over the last decade will know that it’s difficult to get good plans financed and off the ground.

Biden is also showing a willingness to learn from his predecessors. He is definitely avoiding what is now regarded as Barack Obama’s mistake of setting his opening bid for a 2009 stimulus package too low. He is also reviving the Trump administration’s initial intense interest in ways to reform the tax code, and not merely cut rates.

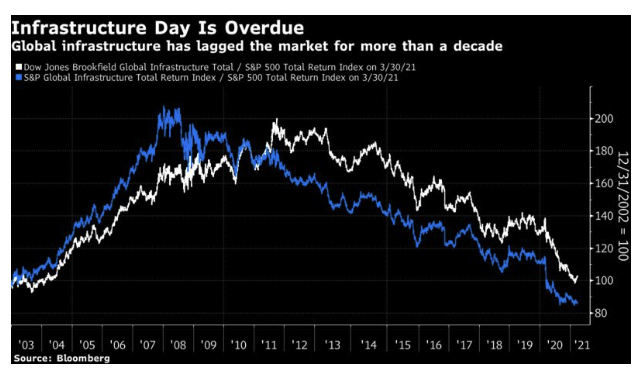

If (and it remains a big “if”) Biden can push a plan through, it might turn out to be a great time to buy infrastructure stocks, which have lagged ever further behind the market since the global financial crisis. They fared very well during the first years of this century on the back of the “BRICS” phenomenon, as investors rushed to finance the development of China and other emerging markets. Since the crisis, infrastructure’s underperformance has been persistent and painful:

The two indexes tell essentially the same story. The Dow Jones Brookfield Global Infrastructure index is a pure play, and has held up slightly better than the S&P Global Infrastructure index, which includes companies with broader businesses. At this point, a spending boost would do both a lot of good. As infrastructure projects, once built, tend to be competitively ring-fenced, with a reliable income stream, they could make a lot of sense.

Those less certain that Biden can pilot extremely contentious legislation through Congress should note that the market reaction was muted; bond yields moved close to the top of their recent range, but the market isn’t going on strike. U.S. stocks remain virtually at an all-time record. This is one case where markets and reality affect each other. If markets stay this unconcerned, the chances that Uncle Sam splashes a lot of money on building stuff look much better. If the bond or stock markets revolt, its chances are much weaker.

Survival Tips

Happy April Fools’ Day everyone (and happy anniversary to my parents, who had a sense of humor when they set their wedding date). This is a reminder to be on the watch for hoaxes as the day proceeds. This year, Volkswagen jumped the gun with a joke about changing its name to Voltswagen, which fooled plenty of people. This wasn’t surprising, as it came out in March. My colleague Chris Bryant describes this as German humor at its best—and VW stock is still higher than it was when the joke came out, so it was a lucrative stunt.

I don’t have the energy to come up with a good April fool, but I can offer two of the greatest British entries: a 1957 Panorama report on the BBC by Richard Dimbleby on the spaghetti harvest in northern Italy; and a travel supplement published by the Guardian in 1977 advertising the Indian Ocean island paradise of San Serriffe. We used to have a tape of David Attenborough (of all people) keeping a straight face for an hour as he described the bizarre wildlife of the Sheba Islands archipelago in a documentary from April 1, 1975, but I can’t find any audio or transcript on the internet. If anyone finds it, let me know.

Meanwhile, as I’ve been writing about gold, you could always listen to Golden Slumbers by the Beatles, or New Gold Dream by Simple Minds (a great album whose title track was playing on the radio the first time I drove across the Golden Gate bridge), or Gold Mother by James, a much-underestimated album, in my opinion.

John Authers is a senior editor for markets. Before Bloomberg, he spent 29 years with the Financial Times, where he was head of the Lex Column and chief markets commentator. He is the author of The Fearful Rise of Markets and other books.