In the week ahead, as has been the case for most of the year, markets will likely take their cues from medical rather than economic data. The key question is whether America will see a second wave in the Covid-19 pandemic. The answer to that question has, of course, profound human and social consequences. However, it also has implications for the economy, for fiscal and monetary policy, and, ultimately, for investment strategy.

Sadly, evidence is mounting that a second wave is indeed upon us, even before the first one has ebbed. Recent weeks have seen a surge in cases with confirmed infections rising by 70% from just over 21,000 per day in the week ended June 6th to just over 36,000 per day in the week ended June 27th. Some have argued that this merely reflects more testing. However, the data clearly don’t support this idea, since the number of tests conducted nationwide rose by only 21% over the same period.

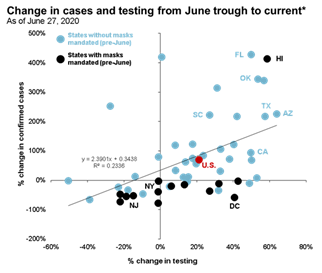

Moreover, as is shown in the chart below, individual state data show enormous disparities in the growth in infections in recent weeks, which appear far larger than any disparities in the growth in testing. In addition, greater local testing is very likely being driven by more people seeking tests as infections rise and so is the result of, rather than the cause of, more infections being confirmed. It should be noted that local regulations do appear to be having an impact on the pandemic, with most states that mandate the wearing of masks seeing an actual decline in new cases over the same period.

Source: The COVID Tracking Project, J.P. Morgan Asset Management. *June trough in cases was on June 9, when 7-day moving average of cases was at its lowest since peaking in April. Percent change in testing = percent change in total testing in week of 6/20-6/27 relative to total testing in week of 5/30-6/6. Percent change in confirmed cases = percent change in total confirmed cases in week of 6/20-6/27 relative to total confirmed cases in week of 5/30-6/6. States with masks mandated pre-June: CT, D.C., DE, HI, IL, KY, MA, MD, ME, NJ, NM, NY, PA, RI. Data are as of June 27, 2020.

It should be emphasized that the news is not all bad. The mortality rate from Covid-19 appears to be falling. In part this is because a greater share of those recently infected are young and mortality rates among the young are lower. However, it also likely reflects the more widespread use of better protocols and drugs in treating the illness, improvements that will hopefully continue in the months ahead. This being said, however, the latest surge in cases will likely boost fatalities in the weeks ahead.

While this is sobering news from a medical perspective, it is unlikely to alter public behavior enough to cause new cases to resume a strong and steady downward trend nationwide. Sadly, the simple but effective steps of social distancing and mask-wearing have become political issues, with millions of Americans refusing to adopt these basic precautions either as an assertion of their individual freedoms or because they believe the news media is overhyping the pandemic.

Regardless of motivation, the behavior of these individuals will make it very difficult to achieve the kind of success in controlling the virus seen in parts of East Asia and more recently in Europe. In addition, there is an understandable urgency to the desire to reopen workplaces and schools, given the economic and personal toll of social isolation. However, even with great attention paid to health protocols, it will be hard to achieve this partial reopening without increasing the risk of infection. Sadly, then, it seems likely that the U.S. will sustain a very heavy level of contagion and fatalities all the way until the widespread distribution of a vaccine, hopefully early in 2021.

From an economic perspective, this rolling-wave pandemic likely eliminates hopes for a full V-shaped recovery in advance of a vaccine. The basic problem is that there are many businesses that cannot reopen in a way that is profitable or sustainable, while still assuring consumers and workers that they are not putting their health in jeopardy. These businesses include a multitude of firms in the travel, accommodation, food services, personal services, entertainment, sports and retail industries.

This problem will likely be in full display in the June jobs report, due out on Thursday. While we believe the economy may have added roughly 2 million jobs in June, this would still leave payroll employment down 17.5 million or 11.5% since February, with more than half the job losses coming in the leisure and hospitality, transportation and retail sectors.