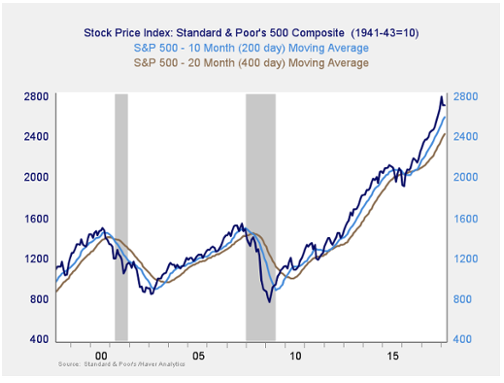

Risk factor #3: Technical factors. A good way to track overall market trends is to review the current level versus recent performance. Two metrics I follow are the 200- and 400-day moving averages. I start to pay attention when a market breaks through its 200-day average, and a break through the 400-day often signals further trouble ahead.

These indicators remain positive, with all three major U.S. indices well above both trend lines. As noted last month, though, the S&P 500 actually dropped slightly below its 200-day moving average on a daily basis on a couple of occasions, then bounced and moved higher. Looking at monthly signals, as this chart does, there has not been a sustained break, but markets continue to bounce around the 200-day line. With no convincing movement either way, the risk of the trend turning negative has risen materially. The most probable case is that the markets may move back up, since they failed to break support even at the nadir. But given the fact that the index did hit its support level, and has not convincingly rebounded above, risks of more volatility have increased. So, I am keeping this indicator at yellow.

Signal: Yellow light

Conclusion: Risks Rising, Conditions May Be Weakening

The overall economic environment remains supportive, and neither of the likely shock factors is necessarily indicating immediate risk. But the continued volatility and the fact that several of the market indicators point to an elevated level of risk—combined with the ongoing policy concerns—suggest that volatility may get worse.

As such, we are taking the overall market indicator to a yellow light. This is not an indicator of immediate trouble—the likelihood remains that the market will recover. Rather, it is a recognition that the risk level has increased materially and that, even if the market recovers, further volatility is quite likely.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions.