My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Market Risk Update. Thanks for the assist, Sam!

April saw markets rebound from the recent lows set in March, as progress combating the spread of the coronavirus gave hope to investors. The S&P 500 gained 12.82 percent during the month, marking the best single month for the index since 1987. While this swift rebound was quite welcome for investors, very real risks to markets still remain—and there are several key factors that matter when determining the overall risk level.

Recession Risk

Recessions are strongly associated with market drawdowns. Indeed, 8 of 10 bear markets have occurred during recessions. As we discussed in this month’s Economic Risk Factor Update, right now the conditions that historically have signaled a potential recession are likely here. On an absolute basis, all of the major economic indicators that we cover monthly are now at a red light. As such, we have kept the economic factors at a red light for May.

Economic Shock Risk

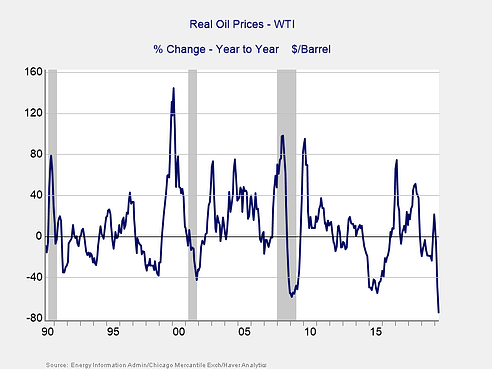

There are two major systemic factors—the price of oil and the price of money (better known as interest rates)—that drive the economy and the financial markets, and they have a proven ability to derail them. Both have been causal factors in previous bear markets and warrant close attention.

The price of oil. Typically, oil prices cause disruption when they spike. This is a warning sign of both a recession and a bear market. In this case, however, the sudden drop is also a warning of significant disruption.