Alan Ruskin, veteran foreign exchange strategist at Deutsche Bank AG, points out that the dollar’s run is less about central banks, and more about the energy price shock on European fundamentals. Indeed, the impact on the eurozone’s current account has been so severe that he suggests that the euro is doing well still to be hovering around parity, rather than weakening further:

A global energy shock has transmitted itself in unique ways to the EUR vs U.S. economy. These differences are also reflected in the S&P’s outperformance vs the DAX by ~10% over the same period. In addition, the energy shocks have added very significantly to EUR balance of payments risks as EUR area’s Current Account shifts from large surplus to deficit, while reducing relative real return dramatically. By that notion, the EUR still tracking in sight of parity is a EUR resilient result.

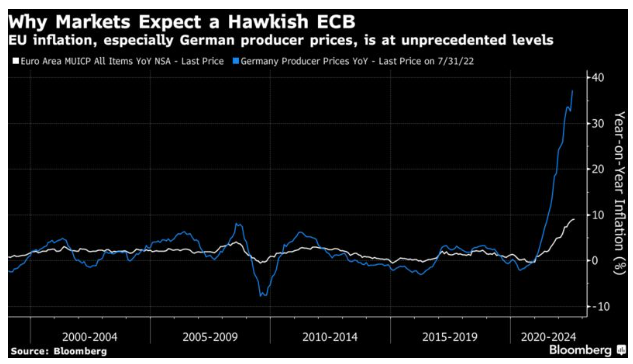

The ECB is of course aware of these solemn developments for the European economy and their likely consequences for growth. It’s also aware that inflation has taken hold in a way never seen since the introduction of the euro in 1999:

Unlike the Fed, the ECB is mandated solely to fight inflation, and not worry about growth. That means, according to Morgane Delledonne, head of investment strategy for Europe at Global X ETFs, that the meeting is bound to be hawkish:

Now the question is whether we have a 50-basis-point rate hike with the hawkish press conference or a 75-basis-point rate hike with the data-dependent more neutral tone. I think that the debate is there. Over the last month, yes, the ECB will have taken into account that we had an upside surprise from inflation and a downside surprise on gas supply from Russia with energy prices continuing to rise. These conditions point to a hawkish meeting. But the positive news I think is that it appears that Russia may have exhausted its economic leverage through gas cuts now. The latest GDP estimate update for Q2 was quite reassuring. When you look at the economic data, you have some resilience across Europe, if you take Germany aside. So I think the meeting will not create much of volatility even if it’s a hawkish meeting. And I think the main outcome would be a strengthened euro.

The key here is that the ECB is viewed as a captive of the unfurling drama over energy prices. The eurozone wants to cut energy consumption by 15%, which already more or less guarantees less growth. The central bank can do nothing about that. If energy prices keep rising, they will have much the same impact as a big fiscal shock, such as a tax hike. That would undermine the euro—even if the ECB does its bit to narrow the gap between yields in Europe and the U.S. In recent days, oil has been falling, thanks largely to pessimism about demand. News of another Covid lockdown in the Chinese megacity of Chengdu reinforces the risks to growth.

That oil price fall is directly helpful to the U.S., where gasoline prices are politically very important and are now almost back to their level before the Ukraine invasion. For Germany and the rest of the eurozone, cheaper oil helps much less because of the critical problem of natural gas supply. The ECB needs to do its job and fight inflation, but between the power of the dollar and the momentous struggle over gas pipelines, it appears to have been rendered oddly unimportant for now.

Now More Than Ever, It’s All About Tech

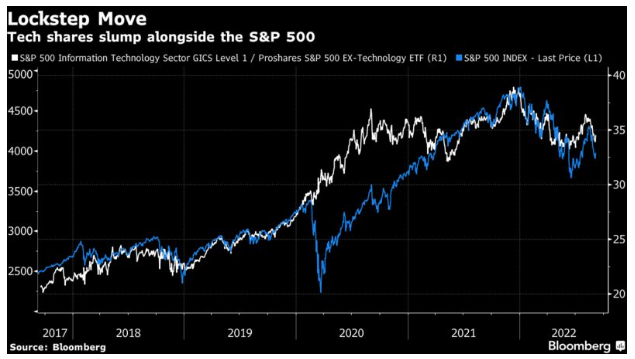

It’s been a tumultuous period for U.S. equities the past few weeks, with many resorting to technical analysis to navigate the market. After a rally that some labeled a new bull market, optimism seemed to fizzle out when the S&P 500 failed to break through its 200-day moving average on Aug. 16.

Since then, the benchmark index has slumped around 16% for the year. It doesn’t help that September, a notoriously volatile month, might see the index retest its June low ahead of multiple macroeconomic events, from the Federal Reserve September meeting to the monthly Consumer Price Index data.

The culprit behind the broader rout? Tech stocks no doubt. The uptrend in U.S. equities broke down due in part to the capitulation of mega-cap tech shares, according to Jim Paulsen, chief investment officer at the Leuthold Group. The sector has had an unparalleled impact on the overall performance of U.S. equities, if nearly 100 years of history are any guide. We wrote about the trend Paulsen observed on Aug. 10. He analyzed data since 1926 and found that the S&P 500 only outperforms when the tech sector does so as well. And just as he might have predicted, the market selloff since then has been accompanied by sharp underperformance by tech stocks. Broader markets have moved in lockstep with the sector since the beginning of this year.