Why tech stocks are going through a beating isn’t difficult to explain. These companies are prone to fears of rising interest rates, especially since many of them are valued based on their projected profits far into the future. And as the Fed launches its most aggressive tightening monetary policy in decades and as yields rise, the future profits of tech firms will be worth far less.

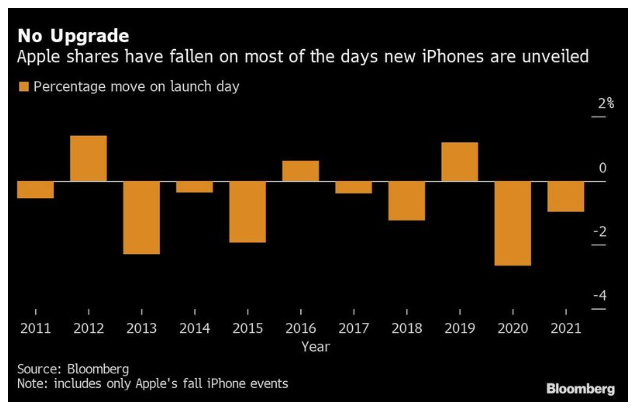

Even Wednesday’s launch of a new line of iPhones by Apple Inc. did little to boost the sector. Shares of Apple, which comprises 13% of the tech-heavy Nasdaq 100, barely budged on a strong day for the broader market, gaining 0.9% to remain some 12% down for the year. But a tepid initial response to an Apple launch hasn’t been unusual in the post-Steve Jobs era. Bloomberg’s Subrat Patnaik reported that the stock has fallen seven times on the day the company has launched a model in the past decade. However, that was usually followed by a rebound over the months after the event; such a respite did not come after either of the last two iPhone announcements:

Why does tech still matter so much? According to Delledonne:

The fact now tech seems to take so much in the market is just a reflection of the underlying economy. We are going through digitization at a rapid pace and this energy crisis just increased the pace of digitizing ... even with increased interest rates, companies should continue to weather higher rates more. I would say what we are seeing in the tech market is more driven by sentiment than actually real fundamentals.

That said, plenty of Wall Streeters are worried about the fundamentals, particularly corporate earnings. Among them is Morgan Stanley strategist Michael Wilson, who cut his expectations for earnings-per-share growth for the year. A slowing economy, he says, will likely be a bigger concern for stocks rather than red-hot inflation and a hawkish Fed. Earnings will be more important still. In fact, he expects earnings to fall 3% next year even if a recession is avoided.

A nuanced view for sure. But here’s Paulsen again offering a sliver of hope for U.S. investors:

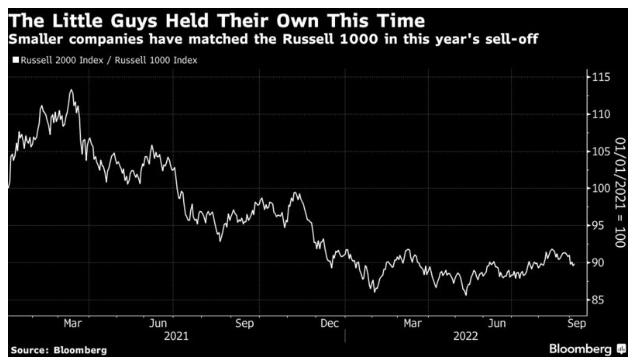

Although technology stocks have led the rout lower, the recent pullback has ‘strong undertones’... On a relative basis, many sectors that normally do best in bull markets—cyclical stocks, high-beta, low-quality, and small/mid-cap stocks—have shown remarkable resilience in the latest downswing and fared far better compared to earlier air-pockets this year... We are hopeful a ‘pullback with strong leadership undertones’ suggests the current market stumble may soon regain its footing and perhaps provide investors with an overdue year-end upside surprise?

And Paulsen is indeed right that small companies are performing relatively much better in this downward wave than in previous selloffs. The Russell 1000 index of large-cap stocks has barely beaten the Russell 2000 small-cap index for this year—although that is in part because of the poor performance of the mega-cap tech stocks:

Even if tech stocks are failing to lead, on Paulsen’s argument, the market’s internal behavior is still consistent with an ongoing rally. As we said about his first piece on tech stocks last month, let’s hope he’s right.

Survival Tips

If you want a great comedy that will delight all the family, I’ve just caught up with a gem from 2007 called Hot Fuzz. Starring Simon Pegg, it features even more British character actors than the average Harry Potter movie. The premise is to parody and lampoon standard U.S. action movies. What would happen if a classic cops movie played out in a sleepy, rural town? “Hot Fuzz” has the answer. Without giving away too much of the plot, this is the final shootout. It’s really good.

John Authers is a senior editor for markets and Bloomberg Opinion columnist. A former chief markets commentator and editor of the Lex column at the Financial Times, he is author of The Fearful Rise of Markets.