What Will Trigger the Next Bear Market?

Every bear market correction since 1947 that didn’t come during a recession was relatively quickly reversed. Think about what happened in 1987 and 1998. There were serious corrections and then a bull market. The bull market that found its footing in 1987 lasted for another 13 years. In 1998, we were only a few years away from a major correction accompanied by a recession. It was in late 1998 and early 1999 that I began writing about a coming secular bear market. Watching the market go even higher throughout 1999 was frustrating, but my book was out, and my words had been immortalized.

Obviously, it’s important to have a sense of when the next recession will happen. But, though the economy is at stall speed and this past week’s employment report proved weaker than expected (though the U-3 unemployment number dropped to 4.5%), there are very few signs that we could actually enter a recession this year.

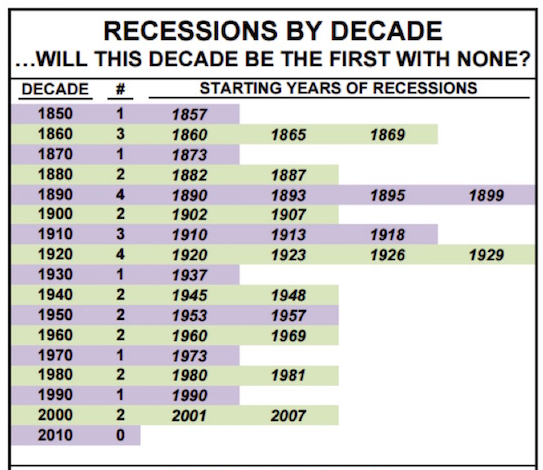

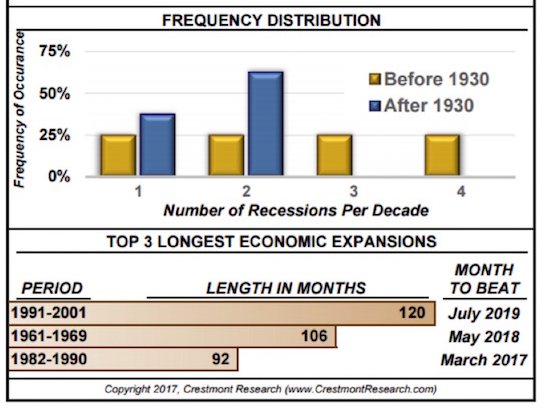

We also have to remember that, as of last month, we are officially in the third-longest period of time since the previous recession. The charts below are again from Ed Easterling’s Crestmont Research, one of the most useful websites I know of.

If there is no recession by 2020, we will have lived through the first decade in 120 years without one. But for that to happen, everything has to go right. We have to have major tax reform – reform that does not include some form of tariffs and/or a border adjustment tax. No tinkering around the edges, no small-ball. We must also have extensive healthcare reform. We have to figure out how to increase the labor force participation rate. And we have to hope that Europe doesn’t blow up, that Italy somehow figures out how to deal with its banking crisis, and that China evades a major credit crisis, etc. – all sorts of things that are out of our control.

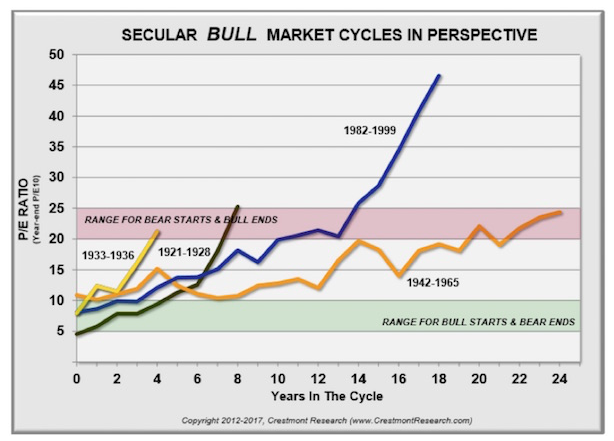

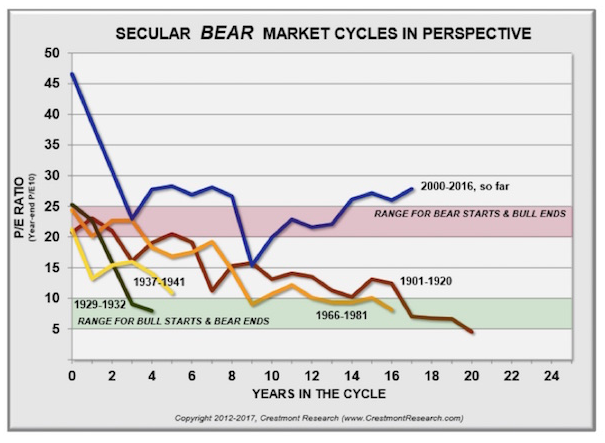

We need to put this post-2009 bull market into some historical perspective. These last two charts from Crestmont Research show the beginnings and ends of every bull and bear market since 1920. Every bull market other than the current one began at a point when the market was at a low P/E ratio, and every bear market began when the P/E ratio was high. Since 2000, though, the market has never returned to low valuations. Valuations certainly went down in 2009, but then they turned right around and started back up. This is the strangest “bull market” cycle so far in the last 100 years. Is it possible that it could be different this time? Certainly; anything’s possible. It’s a bull market, dude!

The market never got to “cheap hamburgers” in 2009. Maybe it doesn’t need to, but we need to be aware that valuations are at such a high level that a fall to a P/E level that would get us back into the green zone where most bull markets start would be a bear market of biblical proportions. Think down over 60%.

Some Final Thoughts from John

I’m not saying that we have to get back to the green area now – at some point in the future that will actually happen – but you need to understand that we are at a very interesting, very challenging juncture, and I don’t think traditional buy-and-hold investing styles will be rewarded very well going forward.