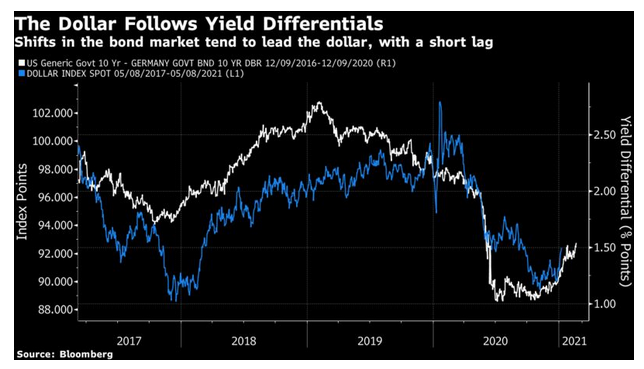

How does this change things? If lots of foreigners pour into Treasuries to take advantage of the higher yields, then the yields won’t rise so much. This was a point that David Tepper, the hedge fund investor who runs Appaloosa Management, made early Monday, to much excitement. That effect hasn’t happened yet. Alternatively, the higher yields in the U.S. succeed in attracting flows that push the dollar up. A higher dollar tends to damp inflation. Over the last four years, there is a distinct tendency for the currency to follow the path set by the gap between U.S. and German bond yields, with a lag of a couple of months. And that is already happening:

The dollar’s rebound has taken many by surprise, and it could change much of the presiding narrative of a big reflation this year. It could also derail investment in emerging markets. Higher Treasury yields have had their customary effect of messing up emerging market carry trades—the practice of borrowing in currencies with low rates and parking in countries with higher rates, pocketing the carry. A promising rebound for emerging carry trades looks as though it has been snuffed out:

Self-Fulfilling Prophecies

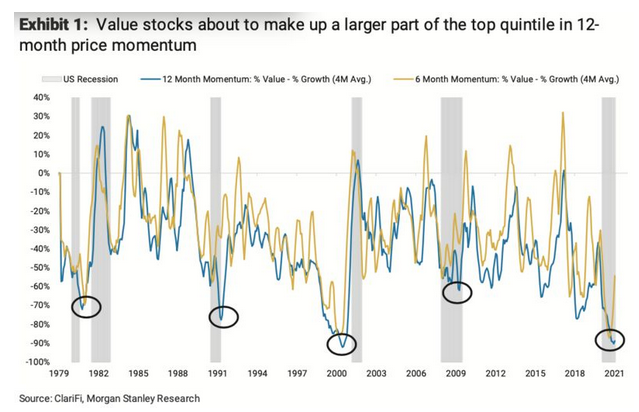

One popular trade among quants is to combine value and momentum. An objection is that the two will tend to cancel each other out, and much of the time they do. But every so often, there is a moment when value stocks have momentum, and the strategy goes into overdrive. Such a moment appears to be at hand.

The following chart is from Mike Wilson, head U.S. equity strategist at Morgan Stanley, who points out that with the anniversary of the great selloff last March, the stocks that appear to have momentum over the last 12 months will change. Rather than being crowded with tech stocks, quants looking to buy “momentum stocks” will instead start to add banks and energy groups. So a rotation that started with a push from economic fundamentals could receive a second wind from technical factors:

This isn’t so much a market stabilizer as a market destabilizer, driven by the weight of money wielded by institutions. This powerful effect could become more disruptive.

The Power Of Bonds

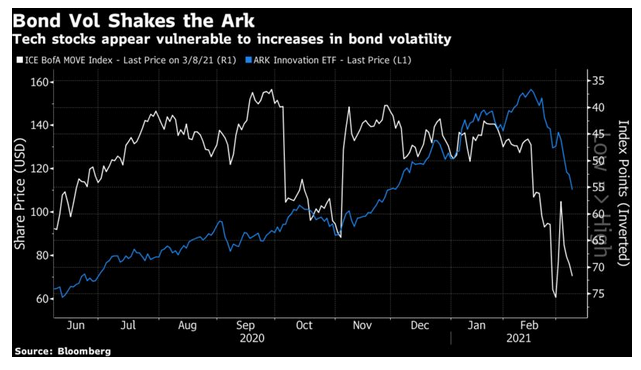

In a way it is the certainty of ‘low forever’ rates and the unlimited buying potential that is most stimulative.This is reflected in bond volatility. But now that the post COVID recovery has begun, now inflation expectations are justifiably rising, and with fears of another high-teens budget deficit, so is bond market volatility.

This is a foundation of markets, a key component of financial conditions. As long rates rise, as bond market volatility increases, funding tightens. We have explained some of the link to other markets, but the market beyond bonds themselves, that is most effected are equities priced using zero cost of capital (unicorns). It is no surprise to see companies making no cash flow, priced off blue sky thinking, falling fastest in this market. We expect this to continue.

And indeed, if we look at the performance of Ark Innovation, compared with the MOVE index of bond volatility on an inverted scale, there is a family resemblance. While bond volatility appears under control, speculative tech companies do very well; any rise holds them back:

Markets don’t just have their own stabilizers. They also have the ability to make a prophecy and know that it will come true. This could be about to happen in the great rotation between value and momentum.

So exactly how much influence do bonds have over stocks? I’d like to mention two interesting angles on this profound question. First, Deltec Bank & Trust Ltd. makes the interesting point that when yields are at very low levels, bond volatility almost by definition gets that much greater when there is any rise. This is the way Hugo Rogers of Deltec puts it: