87. Floating Rate Bonds Eliminate Interest Rate Risk

The vast majority of fixed income ETFs out there focus on fixed rate debt, meaning that the component securities pay an interest rate that remains constant over the term of the debt. That fixed rate is a source of interest rate risk; the longer the term of the bond, the greater the impact on value when interest rates change (prices and rates tend to move in opposite directions). There are also now a number of securities that focus on floating rate bonds, a corner of the debt market that might be appealing to those concerned about an upcoming rise in interest rates. Floating rate debt essentially eliminates this source of risk, since the effective interest paid floats to respond to changes in market interest rates.

These funds represent yet another way to expand fixed income exposure, tapping into a corner of the market that can be used to lower overall volatility while still generating some meaningful yields. Floating rate bond ETFs include:

Floating Rate Note Fund (FLOT)

SPDR Barclays Capital Investment Grade Floating Rate ETF (FLRN)

Market Vectors Investment Grade Floating Rate Bond ETF (FLTR)

Bottom Line: Floating rate bond ETFs allow you to achieve fixed income exposure without worrying about upcoming interest rate hikes.

88. Global ETFs: Not Really All That Global

File this one under "never judge an ETF by its cover." Some of the most broadly-based equity ETFs out there fall into the Global Equities ETFdb Category, a collection of investment products that casts an extremely wide net and generally includes dozens of economies from around the globe. In many cases, however, these "global ETFs" are not really reflective of the global economy thanks to a bias towards developed markets in general (and the United States in particular).

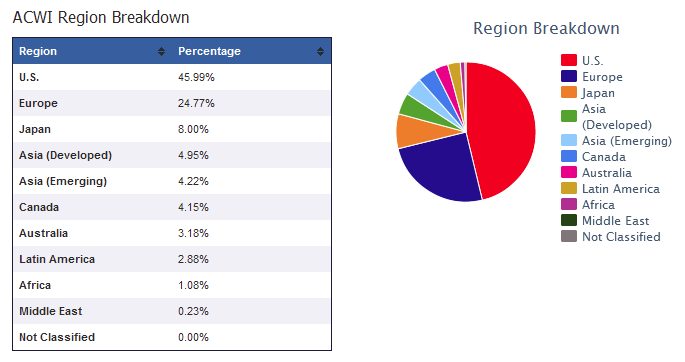

Consider the iShares MSCI ACWI Index Fund (ACWI) as an example. Though this ETF offers exposure to dozens of economies, it is clearly tilted towards the United States. (which represents about 45% of assets). China, the world's second largest economy, makes up less than 3% of assets. Emerging markets in total amount to less than 10%, meaning that developed markets will drive this ETF.

ACWI can still be a very useful tool for a wide range of objectives, but in order to get exposure that truly reflects the global economy, some modifications will be needed.