Bottom Line: Not all dividend ETFs are created equal; some are focused on consistent payers while others hold the highest yielding ones.

91. Super Dividend ETFs You May Be Missing

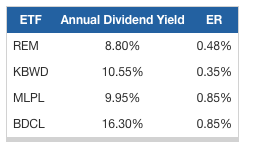

Dividend-weighted ETFs are certainly not the only way to tap into dividend-paying stocks; there are a number of other ETFs out there that implement methodologies designed to focus on this segment of the market. But some of the most attractive distribution yields come from funds that don't necessarily screen by dividends. Below are a few of the highest yielding ETFs out there, providing massive payouts (along with a significant amount of risk):

- FTSE NAREIT Mortgage REITs Index Fund (REM)

- KBW High Dividend Yield Financial Portfolio (KBWD)

- E-TRACS 2x Leveraged Long Alerian MLP Infrastructure Index (MLPL)

- E-TRACS 2xLeveraged Long Wells Fargo Business Development Company ETN (BDCL)

Bottom Line: Some of the highest-yielding ETFs available don't have "dividend" in their name.

92. ETFs To Bet Against The Dollar (CEW, UDN)

There are ETFs for just about every objective imaginable, including placing a bet that the U.S. dollar will decline relative to major (or minor) rivals. Currency ETFs can be used for a wide range of objectives, from speculating on short-term swings in exchange rates to hedging exposures to a specific currency over a much longer period of time.

In addition to a number of currency-specific products, the ETF roster includes a number of "currency basket" products that spread exposure across multiple countries. These can be effective tools for those who believe that the U.S. dollar will generally depreciate over the long haul, but aren't comfortable with concentrating exposure in a single currency. For those looking to bet against the greenback, a couple ETFs that might be worth a closer look:

DB USD Index Bearish (UDN)

Dreyfus Emerging Currency Fund (CEW)