79. TrendPilot ETNs: Cool Tax Loopholes

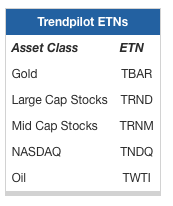

One of the noteworthy innovations to pop up over the last several years involves the combination of exchange-traded products and trend-following strategies. These techniques have been popular for decades: investors move in and out of positions depending on recent momentum and value relative to certain historical moving averages. RBS offers a suite of Trendpilot ETNs that deliver low maintenance to such strategies, shifting exposure between cash and asset classes such as gold, stocks, and oil depending on recent momentum.

Some have complained that these ETNs are too pricey, charging between 50 and 100 basis points for the exposure offered. But there are some unique advantages to these products as well. Specifically, the ETN structure allows investors to avoid paying commissions when moving between cash and other allocations, and allows investors to avoid racking up short-term capital gains when doing so. For many investors those advantages will be more than enough to offset the somewhat pricey management fees.

Bottom Line: TrendPilot ETNs offer access to a "hands-off" investment strategy along with favorable tax treatment.

80. Invest In Southeast Asia

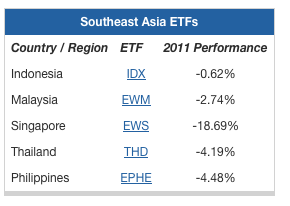

Southeast Asia is home to some of the world's most dynamic economies and fastest-growing markets, which have been thriving for the last several years thanks to favorable demographic trends, strong trade relationships with China and India, and progressive policies that have opened doors to foreign investments. Yet many portfolios have relatively small allocations to the emerging economies of Southeast Asia as the result of the methodologies behind popular emerging markets indexes.

The MSCI Emerging Markets Index, which serves as the basis for EEM and VWO, allocates less than 4% of its portfolio to Malaysia, just 3% to Indonesia (the world's fourth most-populous country), 2% to Thailand, and less than 1% to the Philippines. So for investors who use EEM or VWO for their emerging markets exposure, these rapidly-expanding economies generally represent less than 5% of total equity exposure. Given thetremendous potential for growth in coming decades, that strategy might be less than optimal.

There are a handful of country-specific ETFs out there that can be useful for bulking up exposure to Indonesia, Malaysia, the Philippines, andThailand. Another potentially useful tool for bulking up exposure to this region is the Global X FTSE ASEAN 40 ETF (ASEA), which includes these four markets as well as developed Singapore.

Bottom Line: Increasing your exposure to the emerging markets of Southeast Asia can offer lucrative growth potential over the coming years.