Exposure to emerging markets has become an increasingly important aspect of long-term portfolios in recent years, as these economies have established themselves as the most meaningful sources of GDP growth. Many investors have elected to achieve exposure to emerging markets through ETFs, a logical choice given the numerous advantages of the exchange-traded structure. Broad-based products such as EEM and VWO are a nice start to a balanced emerging markets allocation, but further tuning is required to achieve a truly well-rounded portfolio. And there are ETFs that can help:

Sector-Specific ETFs: As mentioned previously, international ETFs tend to be tilted towards certain sectors and away from others. For those looking to balance out the sector weightings, EGShares has a suite of sector-specific emerging markets ETFs that can be handy tools for increasing weights to the consumer, utilities, and health care markets.

Emerging Markets Bonds: Most investors focus on emerging markets equities, but bond allocations can be just as important in a long-term portfolios. If your fixed income portfolio consists primarily of securities from U.S. issuers, the Emerging Markets Bonds ETFdb Categoryincludes a number of products that could be used to diversify a bit.

Small Caps: ETFs such as EEM and VWO tend to be dominated by large cap stocks. A balanced emerging markets portfolio should include meaningful allocations to small caps; ETFs such as EWX can be a good way to round out your holdings.

Bottom Line: Take advantage of the diverse lineup of offerings when building out your portfolios emerging markets component.

84. How To Invest In The Next Frontier

Emerging markets are only one part of the non-developed global economies; there are also a number of frontier markets that bringtremendous return potential (along with significant risk). Frontier markets are generally considered to be less developed than emerging markets-think of them as in the being in the position that China and India were in 50 years ago. The lack of liquidity and transparency in these markets makes them volatile bets, but the relatively cheap valuations and tremendous growth potential can make them important components of a long-term strategy.

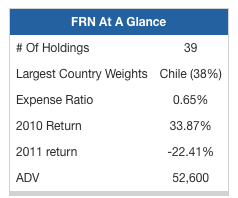

Frontier market stocks generally receive little or no weighting in investor portfolios; emerging markets ETFs often maintain minimal exposure. That means ETFs such as FRN can be useful for adding in some frontier markets exposure.

Bottom Line: Investing in frontier markets holds tremendous potential for upside as well as handfuls of volatility.