95. FCG: A Better Way To Play Natural Gas

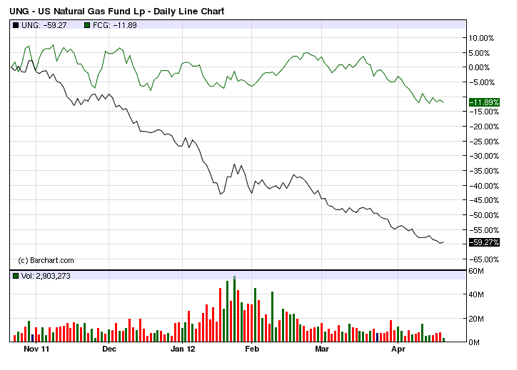

Natural gas has become popular as an investment destination in recent years, as the massive discoveries and technological improvements have made it increasingly likely that this fuel will account for a growing piece of the global energy equation going forward. But tapping into this trend can be tricky; despite growing demand, prices have fallen as supply has surged. Moreover, the persistently steep contango in natural gas futures markets, especially at the short end of the curve, means that products such as GAZ and UNG are essentially facing an uphill fight all the way.

There is, however, an interesting ETF out there that allows investors to place a bet on the long-term success of the natural gas industry: the First Trust ISE-Revere Natural Gas Fund (FCG). This ETF holds stocks of companies engaged in the extraction and discovery of natural gas, meaning that the portfolio consists of the firms that stand to benefit from increased usage of this fuel.

Bottom Line: Natural gas producers may offer a better way to play this segment of the energy market than futures-based products.

96. Watch For New ETPs

Investors are, without a doubt, creatures of habit. So it should be no surprise that there is a tendency to gain familiarity with an exchange-traded product or family of products and repeatedly use those funds in managing their portfolios. Limiting your choices, however, could be a mistake considering the pace of expansion an innovation in the ETF industry. Hundreds of new exchange-traded products are debuting every year, with many of them representing meaningful improvements or enhancements to the existing crop of ETPs.

It makes sense to stay up to date on the latest additions to the ETF lineup, as there is a decent chance that some of the newcomers include funds that can accomplish your objectives with even greater efficiency than those that have been around for years and have accumulated massive AUM and ADV figures. You owe it to yourself and your clients to stay up to date on the latest innovations form the ETF industry .

Bottom Line: The ETF industry is constantly growing and evolving; it pays to stay on top of new releases as they could offer better ways of achieving your objective. The free ETFdb newsletter is a great way to stay connected.

97. ETNs Aren't Evil

Exchange-traded notes are viewed with skepticism by a number of investors, primarily because of the credit risk associated with these debt instruments. While that risk cannot be overlooked, it can also be a mistake to avoid ETNs altogether. As highlighted above there are some instances where ETNs offer substantial advantages over ETFs, including as tools for accessing commodities or implementing trend-following strategies.