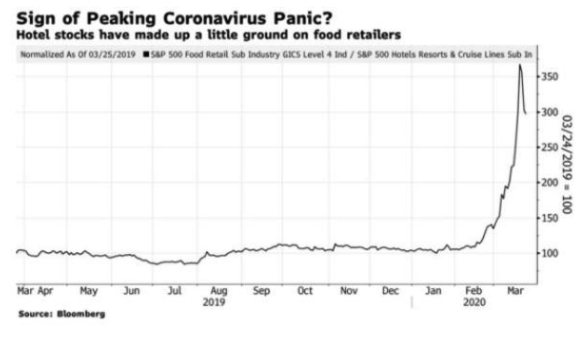

These developments are signs that a) the market is beginning to attempt to price in some very negative scenarios, and b) sentiment is already close to the bottom. For stock markets, and other risk assets, that is good news.

Beyond the imponderable issue of fighting the disease, the key question is whether we can fend off a financial crisis. We should have some clarity within days and weeks.

That was largely right. But I went on to share my brilliant theory that forming a bottom would be a long drawn-out process:

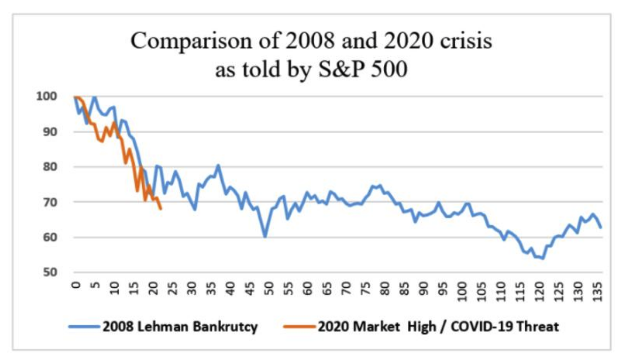

the pattern may well be closest to 2008, after the Lehman bankruptcy. As we can see, there was a clear early panic phase after Lehman, which ended at about this point in proceedings... Once that was over, life in the trading rooms never again felt so scary—though there would two further lows before the recovery began.

It is reasonable to expect that some kind of relief rally will get underway in the next few days. It is also reasonable to expect that the final low is still a ways off. The bottom comes when all hope has been lost, and resignation sinks in.

This was my theory, and I even drew a nice graphic to illustrate it. It proved to be misleading:

This was the newsletter on the Tuesday morning with the maximum buying opportunity, which didn’t tell people to fill their boots, but did at least include this graphic that suggested panic was peaking:

Immediately after Tuesday’s rebound, the most memorable illustration in Wednesday’s Points of Return was this cartoon, from several years earlier, taken from Asterix and the Chariot Race. The crowd are chanting the name of a Roman charioteer: