The Great Shift

Let’s make a big assumption. We really are in the process of not only a great shift toward reflation, but toward a new inflationary regime. What is this like, how can we tell, and what does the future hold?

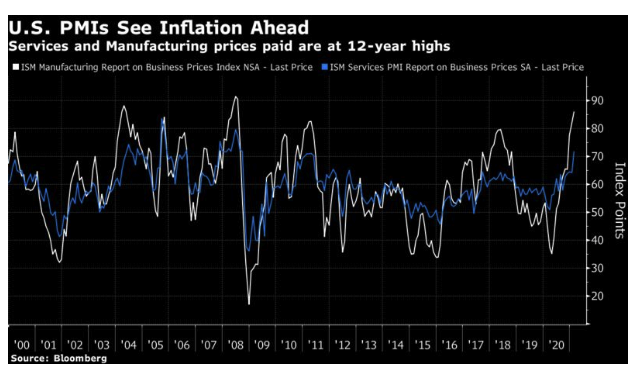

If you want to argue for a new inflationary paradigm, there is plenty of evidence. This week’s U.S. purchasing manager surveys found prices in both the manufacturing and services sectors at their highest levels since the eve of the global financial crisis, and rising fast. These have been good leading indicators of inflation in the past:

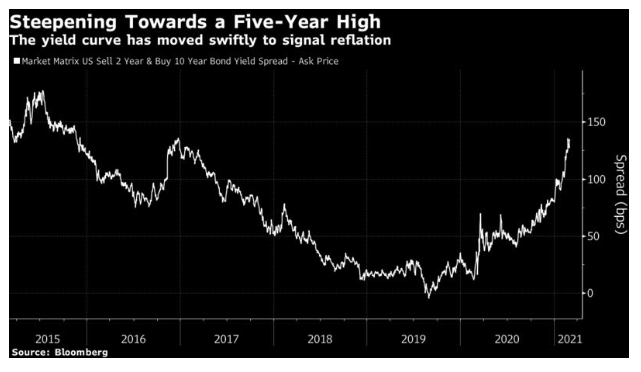

Meanwhile, bond yields climbed sharply across the world, while yield curves steepened. In the U.S., the spread between two- and 10-year yields is its widest in more than five years, barring only a few days after the election of Donald Trump in late 2016:

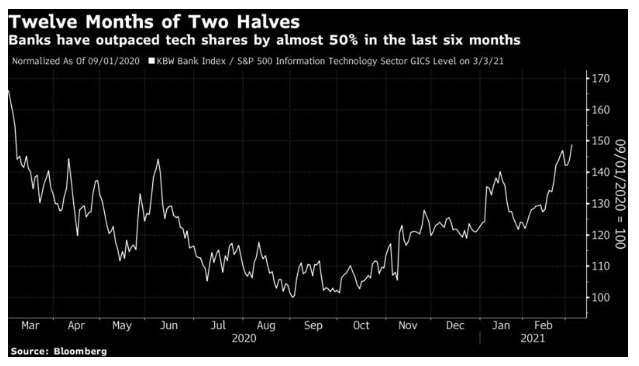

Politicians strengthened traders’ convictions. Wednesday’s annual U.K. Budget, which saw a promise of even more aggressive spending, suggested that fiscal and monetary policy will at last act in unison. Within the stock market, banks (which tend to benefit from higher yields) extended their outperformance of technology stocks (which have prospered from the perception that they can help defend against a slow economy). Since the start of September, banks have outperformed by almost 50%:

But if the broad case for reflation is clear and widely accepted, there is still a question over whether this is a true “regime change.” For four decades, inflation has stayed low and under control, while bond yields have declined. Even with the sharp moves of the last few months, those trends remain intact. Many forces for deflation or disinflation also remain in place. Workplace automation continues apace, reducing prices and the bargaining power of labor.

So, what follows is an attempt to put together a strong case that an inflationary regime change is indeed upon us. To start, let’s return to the last one, some four decades ago.

What A Regime Change Feels Like

It’s difficult to recognize a regime change in real time. My exhibit is America in Search of Itself by the great political journalist Theodore H. White. In it, he chronicles all the presidential elections from 1956 to 1980, and explains the forces that contributed to the election of Ronald Reagan in 1980, one of the sharpest political changes of direction the West has seen since the war. He devotes an entire chapter to “The Great Inflation,” which, he said, touched everyone and was “the main thrust of Ronald Reagan’s attack on Jimmy Carter.” The following passage is a beautiful piece of journalistic prose:

“Inflation has no date of beginning. Inflation is the cancer of modern civilization, the leukemia of planning and hope; as with all cancers, no one can say when it begins or how fast it may spread. It is a disease of money, and when money goes, order goes with it. Inflation comes when a government has made too many promises it cannot keep and papers over the shortfall with currency which, ultimately, becomes confetti—and faith is lost.”