Indeed Lawrence Summers, the former Treasury secretary who coined the phrase, has in recent weeks been cautioning about the risks of overdoing fiscal stimulus. More or less all the conditions for changing a regime are in place. Many still think that deflation and inequality are deeply ingrained and cannot be averted—but then that’s what Theodore H. White thought when the last great inflationary regime shift was already under way.

What To Do

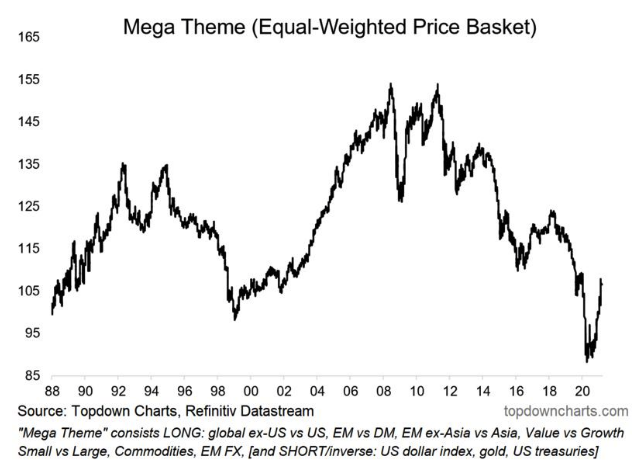

If a regime change is upon us, what do we do about it? For now, there is a close comparison with the market that preceded the GFC. That decade was driven preeminently by the growth of China, and numerous trades tied to the country’s strength did well. Part of the 2008 disaster sprang from the fact that investors thought they were diversified when in fact they had just made the same bet many times over in different asset classes. The following chart from Topdown Charts of New Zealand shows the performance of an equally weighted “mega-theme” portfolio, of 10 separate trades. These include betting against the U.S., plunging into value stocks, and investing in the emerging markets and commodities complex:

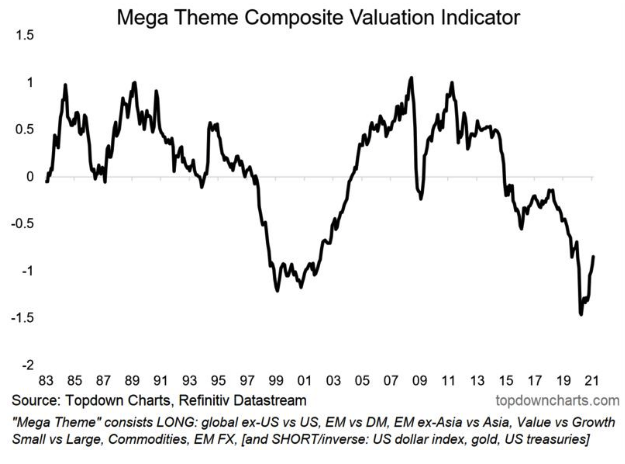

China won’t be the leader to the same extent this time, but the same trades should all prosper in a broadly reflationary environment, this time fueled by expansionist policies and attempts to build green infrastructure. This cycle could play out very quickly, Papic of Clocktower warns, and might easily end within a year or two with some kind of “fiscal cliff” drama, as politicians balk at continuing to pay the bill. The basket’s valuation suggests the trade could have a long way to go:

By the reckoning of Callum Thomas, Topdown Charts’s head of research, this mega-theme basket is only slightly more expensive than it was at its turn-of-the-century low—when a massive rally lay ahead.

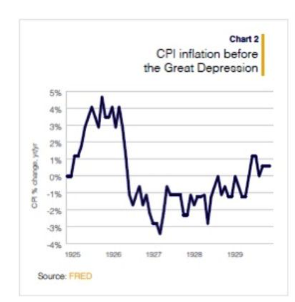

What of the risk of a bubble from here? It’s substantial, as money is already plentiful and seemingly about to become more so. Grice suggests that Powell’s approach leaves him open to making a “new old mistake,” in which the Fed takes comfort from low and stable inflation and thereby fails to act against a build-up of speculation. This is the inflation pattern that lulled the Fed into a false sense of security ahead of the Great Crash of 1929:

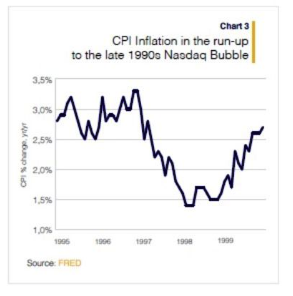

And these are the inflation numbers that helped dissuade the Greenspan Fed from a decisive attempt to puncture an asset bubble (the “irrational exuberance” speech came at the end of 1996) ahead of the internet mania: