Also, stocks are relatively cheap (according to the Shiller CAPE).

The Cons: The current withdrawal rate of 15.5% is much higher than it was on the regime chart. Inflation has accelerated dramatically and appears to be out of control.

Recommendations: What action, if any, should be taken to resuscitate this withdrawal plan?

The cons appear to outweigh the pros; therefore, we apply a “cure.”

Inflation appears to be a horrendous problem, causing dollar withdrawals to balloon each year. The sustainability of the portfolio is clearly threatened.

This is no time for halfway measures. Although the investor began with a “low” 5.2% withdrawal rate (relative to the presumed moderate inflation regime), the subsequent surge in inflation suggests that a high-inflation regime now obtains, and the 4.5% “SAFEMAX,” would have worked better originally. The inflation situation appears worse than in the 1970s, so I recommend a 30% cut in dollar withdrawals beginning in the 11th year.

This is a case based on hypothetical data. Because the high levels of inflation persisted for several more years, the first round of “cure” proved inadequate. The adjusted portfolio would have terminated in only 21 years. Further measures were judged necessary.

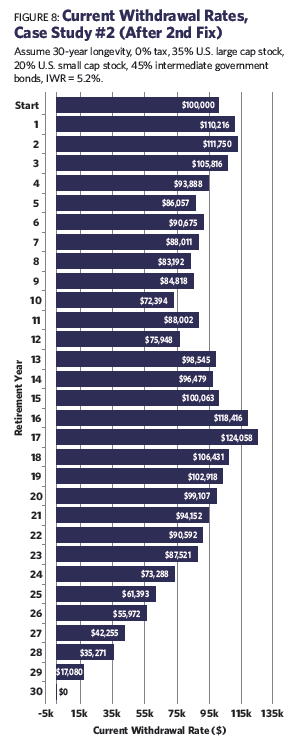

Two years later, a further 35% cut was made in withdrawals. This was successful in extending the portfolio’s life to the intended 30 years (Figure 8).

The retiree is now faced with living on just 45% of the portfolio withdrawals he had enjoyed only two years earlier. This is likely to be traumatic. Had the retiree acted five years earlier, in the sixth year, a single reduction of 35% would have sufficed, rather than the 55% that was ultimately required. This would have been painful, but far less so than the draconian measures eventually employed.

This case illustrated an inflationary episode of unprecedented severity (at least for the U.S.) coupled with poor investment returns. Had no remedial measures been taken, the portfolio would have been exhausted in just 17 years. This underscores the need for early and decisive adjustments when a high-inflation regime appears. In my opinion, high inflation, not stock markets, is the gravest threat to the viability of retirement plans.