Credit And Real Estate

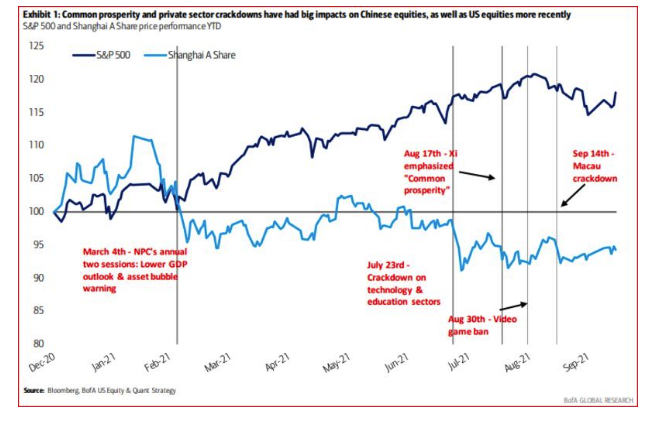

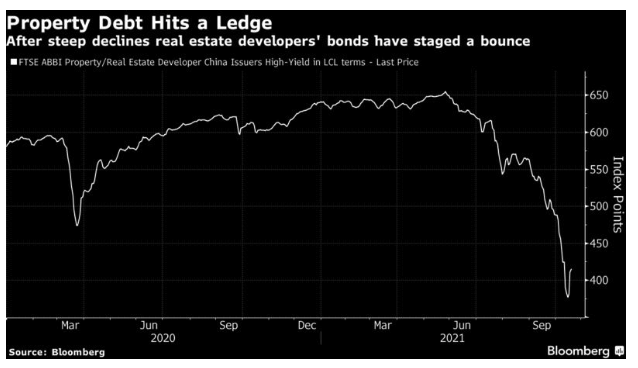

The main reason the Chinese authorities might want to rein in credit lies in its over-indebted property sector. This is why the travails of China Evergrande have attracted international attention. Its problems meeting payments sparked a dramatic selloff of high-yield bonds issued by developers, suggesting that the entire sector was thought to be in danger of going the same way. They staged a small bounce this week that has calmed nerves outside China, although for the moment it looks like one of the “dead cat” variety:

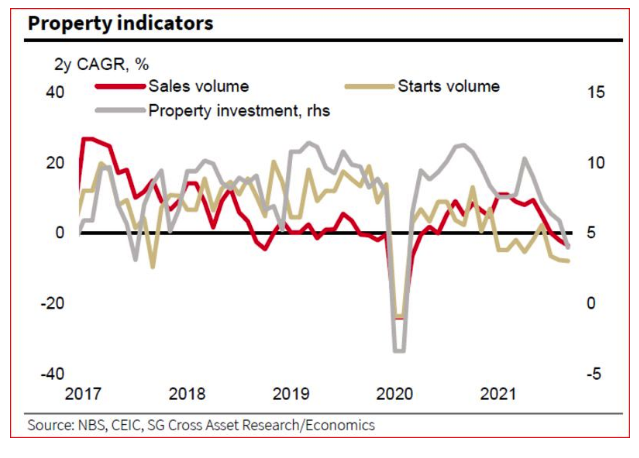

The intent, plainly, is to slow the property sector, and squeeze out speculative excesses. As with money supply, this is probably good policy, but likely means a reduction in the previously insatiable Chinese appetite for industrial materials used in construction. As this chart from SocGen’s Yao shows, the property sector is unambiguously slowing—and again, to avoid base effects, this chart is on a two-year annualized basis:

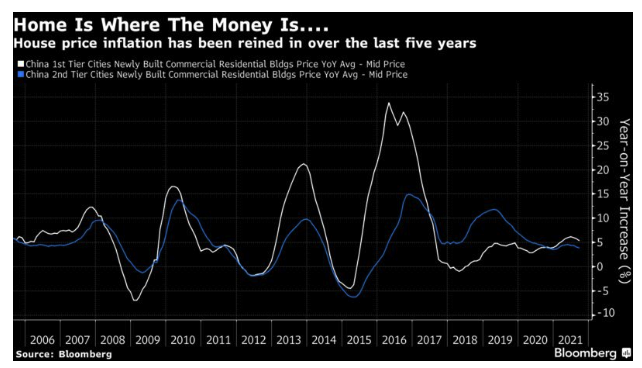

This can also be seen in the decline in house price inflation, which went ballistic at times during the last decade while also falling outright in some years:

So far, the signs are that Evergrande hasn’t triggered a Lehman-style implosion. The risk remains that an enforced slowdown for Chinese real estate has a more insidious effect on global growth.

Stock Markets

So far, the Chinese slowdown has had little impact on American animal spirits. Beyond that, the impact is complicated because there are so many strands to follow. BofA provides this handy chronology:

What effect will all of this have on global stock markets? On the face of it, a China that will accept growth of less than 5% is a very big deal. In recent years, BofA Securities Inc. shows that the S&P 500 was more closely correlated with Chinese GDP growth than with the pace of expansion in the U.S.: