Meanwhile, In Cryptoland

Cryptocurrencies continue to shoot for the moon, propelled there, it would appear, by Tom Brady. The hype is deafening once more, thanks largely to the launch of an ETF that can give you crypto exposure without the trouble of buying a bitcoin. As a result, bitcoin is at another all-time high.

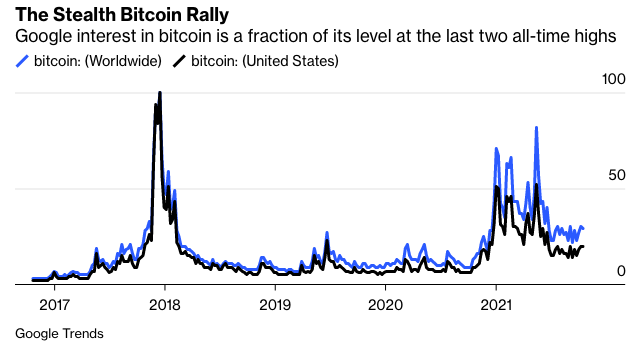

One thing is different about this craze. Among the public as a whole, it isn’t a mania, and the riches you can make in cryptocurrencies don’t dominate discussion in anything like the way they once did.

To demonstrate this, here are Google Trends searches for “bitcoin,” for the U.S. and the world. The lines are relative to their own high, and both peak in late 2017. The exercise shows that there is far less interest in bitcoin now than at that big top. The same goes for the cryptocurrency’s subsequent record rallies in late 2020 and the first months of 2021. Indeed, this all-time high scarcely seems to have prompted any attention:

It’s faintly possible that this tells us many of those likely to invest in bitcoin have already done so. A more likely scenario for now is that this rally has been dominated by institutions catching up with the phenomenon, rather than by retail buying. The effort to institutionalize bitcoin is underway; people in the real world are getting used to the notion of bitcoin and cryptocurrencies, and don’t feel so much need to jump on Google to research them.

Survival Tips

Working From Home still means occasionally Appearing On Television From Home. And that occasionally means that family spills over the airwaves. This discussion of the change of leadership at the Bundesbank from Bloomberg Surveillance this morning was a classic of the genre. Enjoy.

John Authers is a senior editor for markets. Before Bloomberg, he spent 29 years with the Financial Times, where he was head of the Lex Column and chief markets commentator. He is the author of The Fearful Rise of Markets and other books.