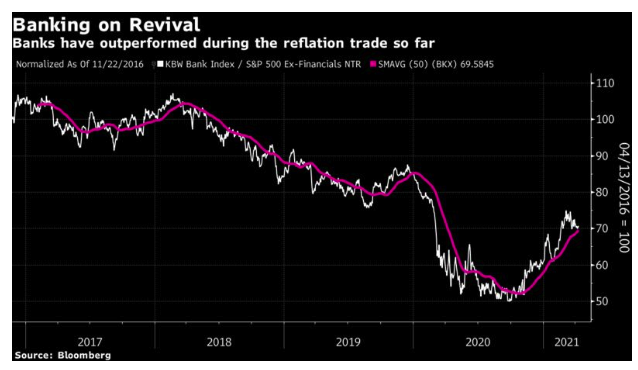

Brace yourself for base effects. The great reflation trade of 2021 faces an important confrontation with hard data over the next few weeks, as companies begin to announce earnings for the first quarter. As usual, the banks will go first, and they will be an interesting test of what is to follow. No sector has benefited more directly from the “reflation trade” of the last few months. Banks borrow short-term and lend over lengthier periods, so are helped by higher yields and a steeper curve (meaning longer-term rates rise by more).

Just as the bond market has been on pause for the last few weeks, so also the banking sector is taking a slight pause. This is how the the S&P 500 financial sector has performed compared to the rest of the index:

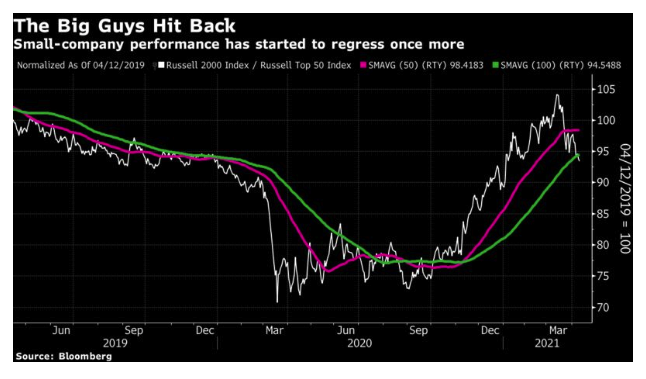

There are other signs that the market is embarking on a repositioning. Smaller companies have far outperformed since encouraging vaccine test results started to appear in November. This is a sign of robust confidence in an economic recovery, which can generally be expected to raise all boats — and thereby help out the smaller craft the most. In the last few weeks, smaller companies have again started to underperform the “mega-caps” that represent the greatest safety, in another sign of what might be nerves about economic reopening:

What is going on? Michael Wilson, U.S. equity strategist at Morgan Stanley, suggests these should be taken as “potential early warning signs that the actual reopening of the economy will be more difficult than many believe.” With markets having discounted the recovery that is now taking shape, they have to execute, “and with that comes execution risk and potential surprises that aren’t priced.” It is probably best to view the entire earnings season as a big exercise in revealing how the recovery is going so far, and what executives expect for the future.

Wilson also suggests that as far as the market is concerned, the recovery has already shifted from early to mid-cycle. This may seem barmy to many, as life drags on much as it has during most of the pandemic. The vaccination program is far from over, and the same is true of the pandemic. But it is the job of markets to discount the future, and the initial recovery phase has already been priced in. That it has happened this quickly is because of the phenomenal pace of this cycle. The downturn was the fastest on record, and much the same can be said of the recovery. That scrambles perceptions, and raises the risk of mistakes.

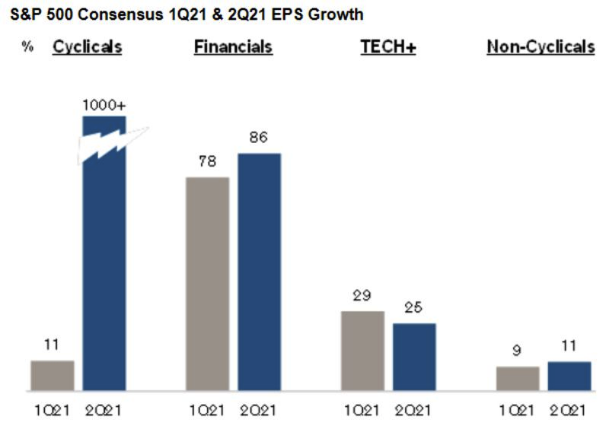

For exhibit a), look at expected year-on-year earnings growth for the first and second quarters, as measured by Jonathan Golub of Credit Suisse Group AG:

The percentage increases on the scale currently being discussed are hard to process and must inevitably come with wide error bars around them. The first quarter will be impressive, and then the second quarter, as shown in the following chart from Morgan Stanley, will be something else: